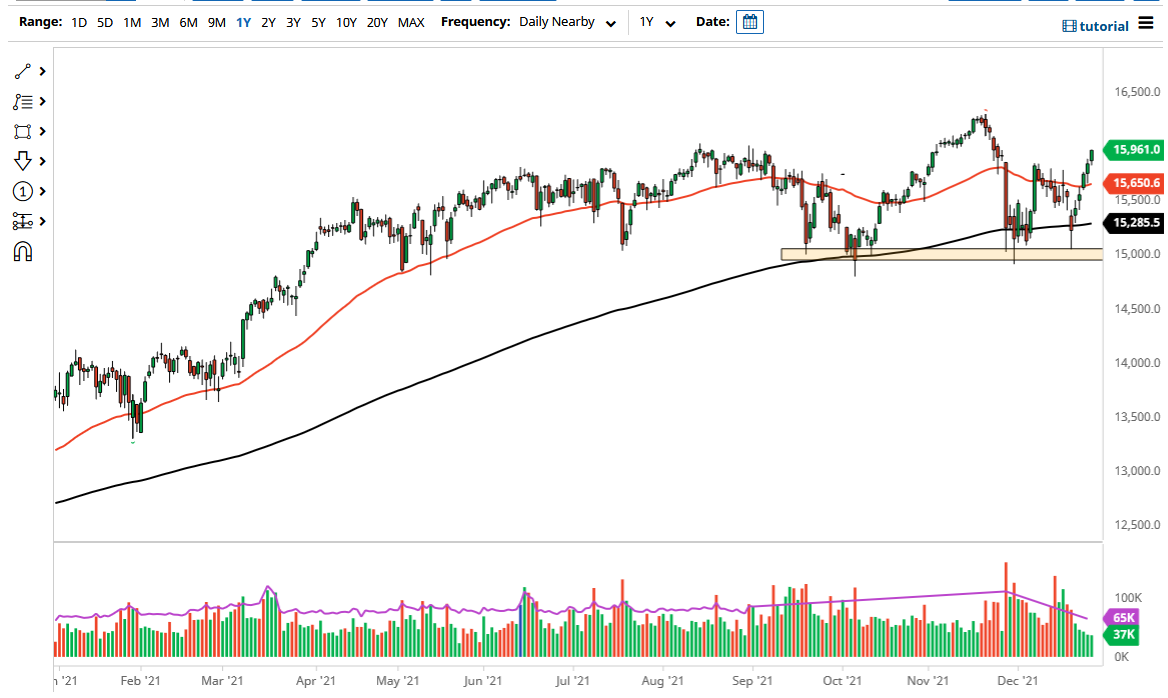

The German DAX Index had a very strong session on Tuesday, reaching towards the €16,000 level. At this point, it looks like we are trying to break out to the upside and rally a bit, and that of course is a very good sign. The DAX should drag the rest of the European indices right along with it, as it is considered to be the “blue-chip index” for the EU. As long as this one rises, as a general rule most other indices in the European Union should do fairly well.

Below here, the €16,750 level is an area that should be supportive as well, so I really look at any pullback at this point in time as an opportunity to pick up a little bit of value. The next couple of sessions will probably be very noisy, but ultimately I think we are going to continue to see the overall upward trajectory play out, as the DAX will go looking towards the all-time highs again.

When I look across the world, it appears that the risk appetite trade is going to come in with both feet after New Year’s Day, so I am looking at the DAX the same way I am looking at several other indices, where I need to see a little bit of a pullback to offer value so I can get involved. Once that happens, then I more than willing to start adding to a position for next year, because most traders will be doing the same thing, putting on risk to get the year started on the right foot. The DAX is one of the most stable indices out there to trade, so it does make sense it would lead the way. As long as this market stays above the 15,000 level, I just do not see any reason why you should consider selling the DAX, because there is so much support at multiple levels between here and there, and stock markets in general all look about the same right now, suggesting that they are going to be a buy as we kick off 2022 over the next couple of sessions. I believe that we will have all-time highs, and then go looking towards 16,500 rather quickly after that. In general, I plan on playing this market.