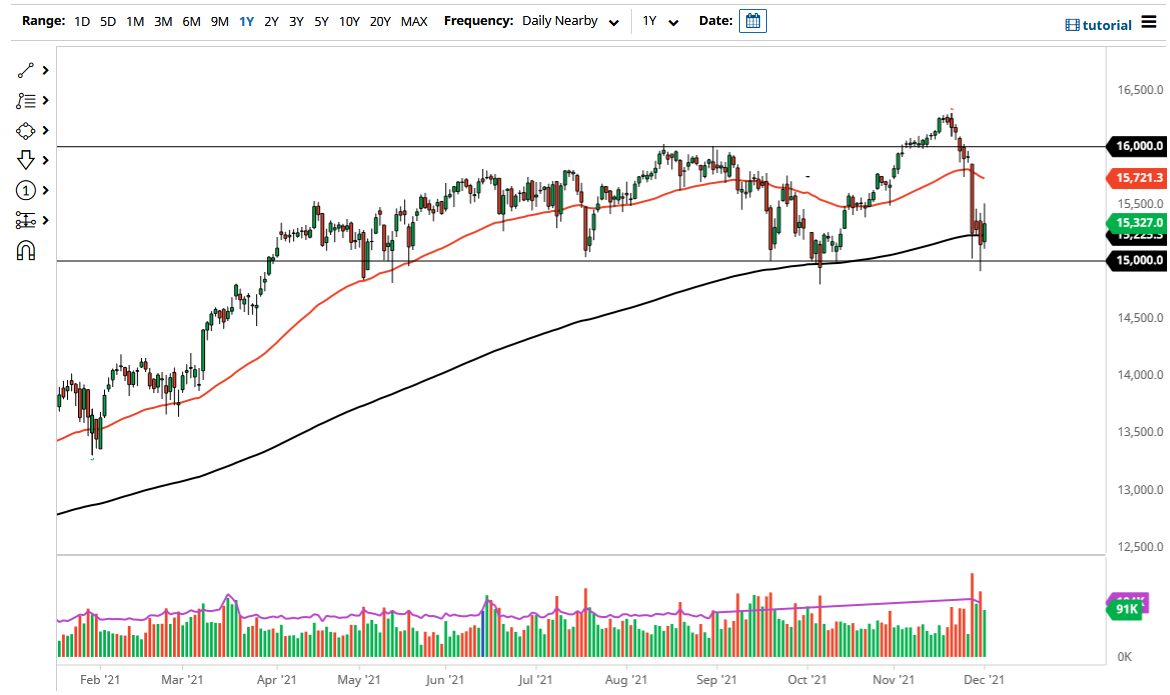

The DAX initially rallied on Wednesday, but as you can see, we have struggled to get above the €15,500 level. By giving back some of the gains, it shows that we are still hanging about the 200-day EMA and trying to figure out whether or not the uptrend is going to stay intact. The €15,000 level is an area that a lot of people will have to pay close attention to due to the fact that it is a large, round, psychologically significant number, and where we have bounced from previously.

If we were to break down below the candlestick for the Tuesday session, that would have the market clearing the €14,900 level, perhaps opening up a bigger selling opportunity. The DAX is hanging onto the 200-day EMA for its very life right now, so I think the next couple of days could be crucial. The Thursday session might be a bit quiet as we are waiting to see what the jobs number in America is like, as Germany is a major exporter and will be looking for consumers.

The euro has rallied a bit as of late, but it is still historically cheap, so it means that exports are cheap as well, which of course helps Germany. On the other hand, we also have Germany possibly shutting itself down if the politicians are to be believed. If that happens, then obviously it is going to be toxic for the economy. Keep in mind that the DAX also has to rely on a little bit of risk appetite, something that seems to be lacking in general. This is a market that will make a bigger decision soon, so I am going to pay close attention to this range we are in, because once we break out of that I think a bigger move is almost imminent. As we head into the end of the year, there will be traders out there trying to make their money, so it will be interesting to see how they play the DAX. Expect choppy and noisy behavior, but eventually we will get a relatively impulsive candlestick that we can pay attention to and start trading the market.