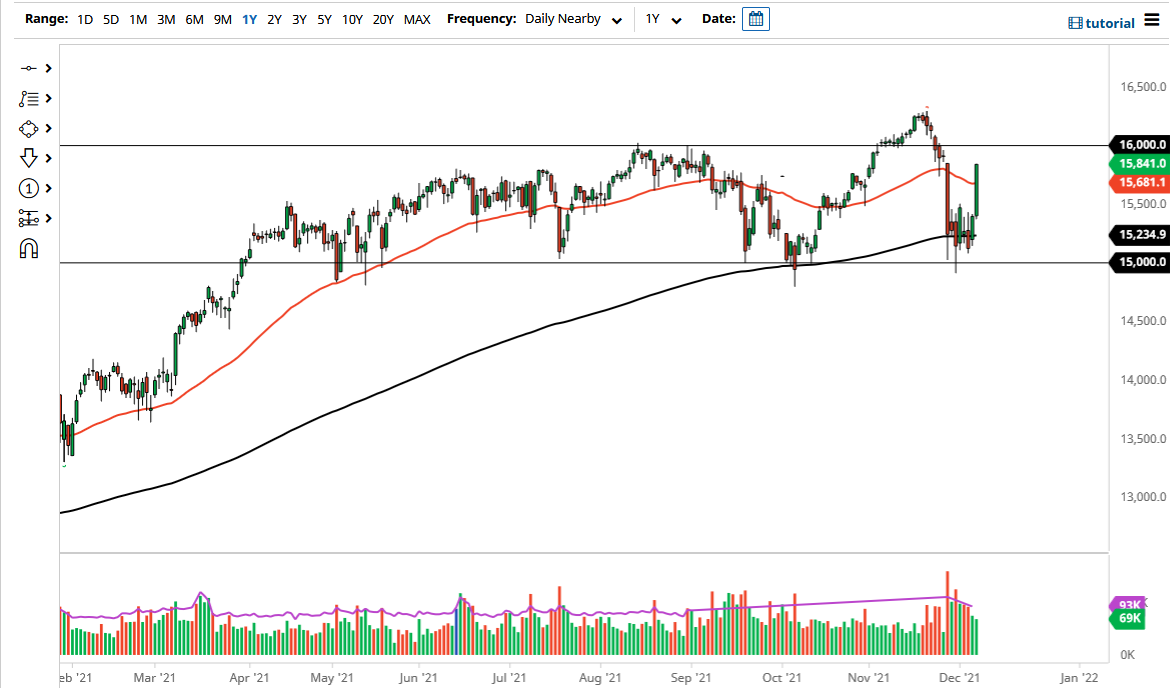

The DAX Index shot higher on Tuesday, breaking above the resistance barrier at €15,500, followed by a break of the 50-day EMA at the €16,680 level, and closing at the very top of the massive meltdown candlestick from last week. The fact that we closed at the very top of the range for the day also suggests that we should see continuation, something that I am seeing across-the-board when it comes to European indices.

Germany is one of the first places that people will put money to work in when it comes to the European Union, so it is not a huge surprise to see this market take off, dragging other European indices right along with it. Up next, we have the €16,000 level that could cause a bit of trouble. If we can clear that level, then it is likely that we will go to the recent highs at the €16,300 level. Any break of that is not only a fresh, new high, but it also would open up quite a bit of short selling as well.

When you look at this chart, you can see that the 200 day EMA currently sits at the €15,271 level, which is quite far below where we are. Any pullback at this point in time will probably show up as a value play that a lot of people would take advantage of. After all, I think it is obvious that the market wants to go higher, and a lot of traders will have perhaps missed this opportunity. Think of this as a “buy on the dips” type of scenario, as we have clearly wiped out a lot of the sellers. Think of it this way: If you were a short seller in this marketplace, would you feel comfortable after the candlestick for Tuesday?

In fact, it is not until we break down below the €15,000 level that I would consider shorting this market, something that does not look very likely to happen. If we were to break down below that level though, it could open up a huge bear market in this index. The market had recently been chopping around in a €1000 consolidation area, and now it looks like we are ready to rip through the top of it and continue going higher. It is the “measured move” that makes me think we are trying to get to the €17,000 level.