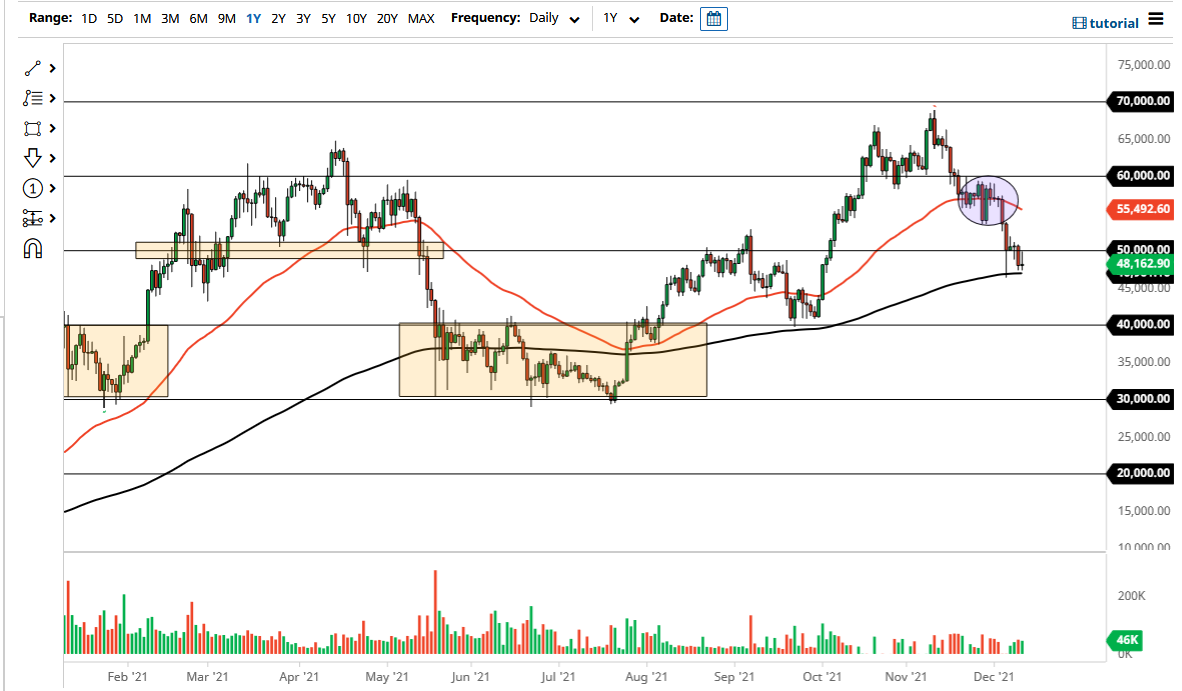

Last Monday’s BTC/USD signal was not triggered as there was no bearish price action when the price first reached the resistance level identified at $49,710 that day.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken before 5pm Tokyo time Tuesday.

Long Trade Ideas

Long entry after a bullish price action reversal on the H1 time frame following the next touch of $46,381, $45,261, or $42,651.

Put the stop loss $100 below the local swing low.

Move the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

Short Trade Ideas

Short entry after a bearish price action reversal on the H1 time frame following the next touch of $49,923, $50,954, or $51,912.

Put the stop loss $100 above the local swing high.

Move the stop loss to break even once the trade is $100 in profit by price.

Remove 50% of the position as profit when the trade is $100 in profit by price and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote last Monday that the short-term price action was clearly bearish. I saw every reason to expect a continued downwards movement in the price, to at least the support level at $46,381.

I was also prepared to take a short trade from a bearish reversal off $49,710 if it had set up.

This was not a good call over the short term as the price rose that day and did not reach $46,381. When it hit overhead resistance, the price kept rising through it. However, the price has failed to rise since then, and has traded sideways over the past few days.

It is difficult to think of anything useful to say for anyone who wants to trade Bitcoin today beyond the fact that the price is in a consolidation pattern with low volatility. So, it can be said that the price is very likely to remain between the nearest support at $46,381 and the nearest resistance at $49,923 over the course of today. This means that the best trading strategy here for today will be to trade reversals from either level. I think that the support level is likely to be stronger than the resistance. However, it should worry Bitcoin bulls that Bitcoin is flat at a time when stock markets are rising, so there may be good potential on the short side despite the likely near-term strength of $46,381 as support.

There is nothing of high importance scheduled for today regarding the USD.