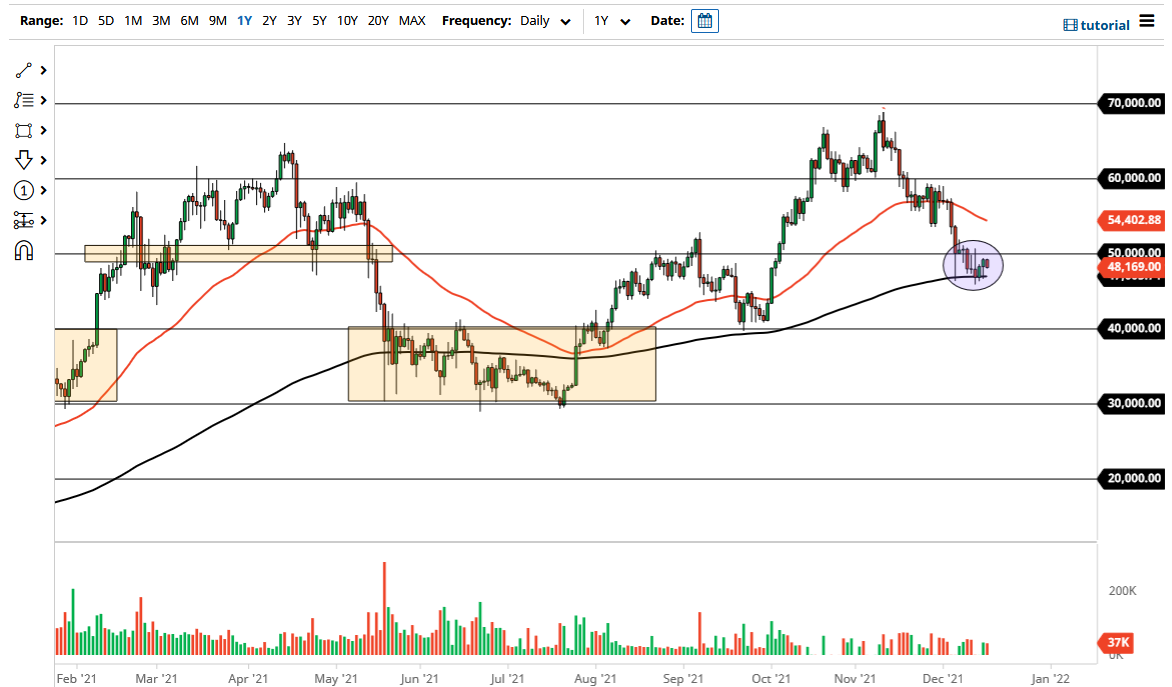

The Bitcoin market has fallen just a bit during the trading session on Thursday as we continue to trade back and forth overall. Ultimately, this is a market that I think continues to look at the $50,000 level above as a barrier, while the 200 day EMA underneath is more likely than not going to continue to offer support. In other words, we are basically trading between the $47,000 level on the bottom, and the $50,000 level on the top.

We are hanging just above the 200 day EMA which in and of itself does suggest that we are trying to build up a little bit of buying pressure. In that scenario, I think what we have is the ability to possibly grind sideways for a little bit, before taking off in one direction or the other. As things stand right now, I would like to see this market break above the $51,000 level in order to get aggressively bullish again, something that I suspect is more likely than not. Having said that, if we were to break down below the $45,000 level, it could simply be a bit of a “reset” in the market, offering extreme value early next year.

Keep in mind that this is the end of the year and of course money managers are going to have to book gains. Furthermore, as we have a lot of economic uncertainty out there, the idea that Bitcoin would be immune is laughable at this point. Remember, a couple of years ago there were no large money managers in this market, but now that has changed. Regardless, I look at any dip as a potential buying opportunity, not only in Bitcoin but in other major crypto markets such as Ethereum.

Early next year, I expect another leg higher, but we have not seen that play out into the year-end, something that I thought might happen. Obviously, there are a couple of weeks left, and it would not be completely out of the question for Bitcoin to break well above $60,000 in that short of a timeframe, but right now we just simply lack the momentum. I anticipate that given enough time we will more than likely find plenty of buyers but that might be a scenario for early January at this point. Either way, I am not a seller or worried about this market until we break down below the $40,000 level.