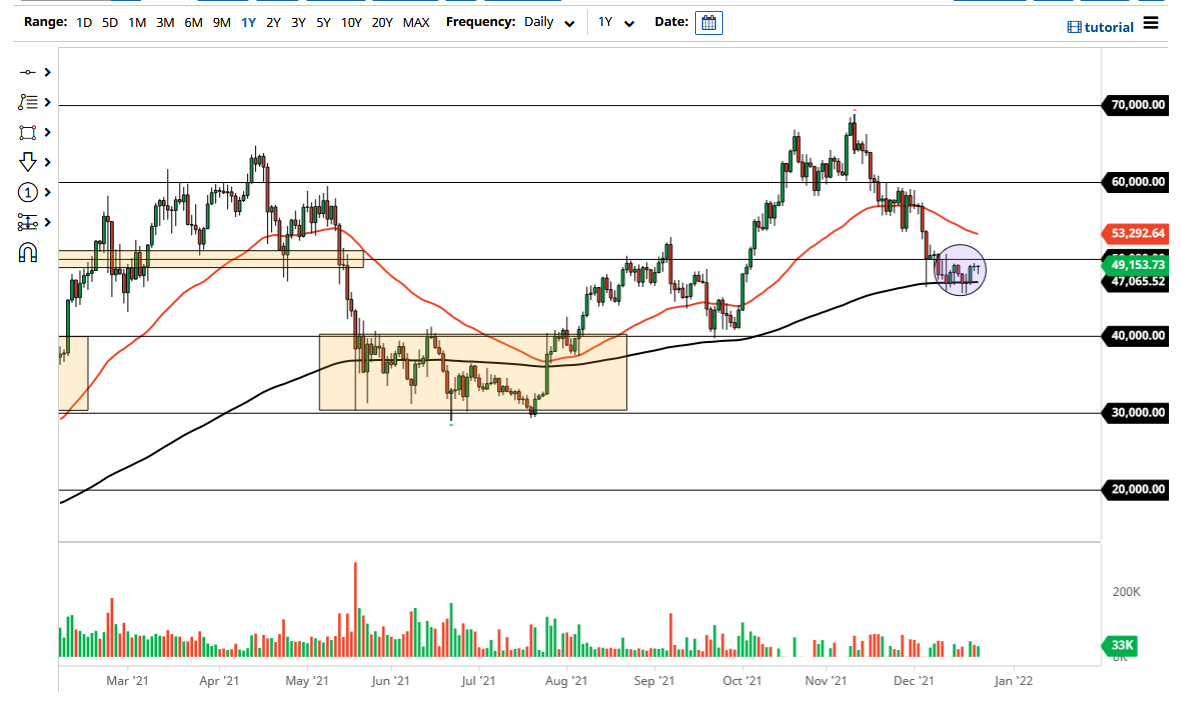

Bitcoin markets dropped a bit to kick off the trading session on Thursday, but then turned around to recover all of those losses. At this point, the market sits just below the $50,000 level, which of course is a psychologically important figure. $50,000 has been both psychologically and structurally important several times in the past, so the fact that we are struggling here to break out would not be a huge stretch of the imagination.

If we can take out the $51,000 level, then at that point I would be convinced that the market could run quite a bit higher, perhaps reaching towards the $60,000 level. In fact, I believe that is what happens, but I do not know if it happens between now and New Year’s. Liquidity is going to be a major issue obviously, and that will probably be even worse in the crypto markets. Either way, I do not see anything on this chart that tells me I should be a seller, because at the very least we are starting to stabilize after a big move lower. Bitcoin tends to move in the cycles, so at this point I am not surprised at all to see that we are stabilizing and will be looking to turn things around again.

If we did break down below the $46,000 level though, then we may go looking towards the $40,000 level next. That is where the rubber meets the road for me, meaning that if we cannot keep $40,000, then I would be very concerned about the overall health of the market. Bitcoin is of course very volatile under the best circumstances, so the fact that we are stabilizing is actually a good sign because it shows that there is not a bunch of fear in the market right now. That does not necessarily mean that there is a lot of greed, but clearly people were not overly concerned about the market. It is in those scenarios that you see people start to jump in, and then eventually push it higher to get other people to start chasing. Bitcoin has the 200 day EMA sitting just below, which of course is a major indicator that people follow, but it has the 50 day EMA up at $53,236, meaning that it may struggle to get above there if and when we do get that bigger breakout.