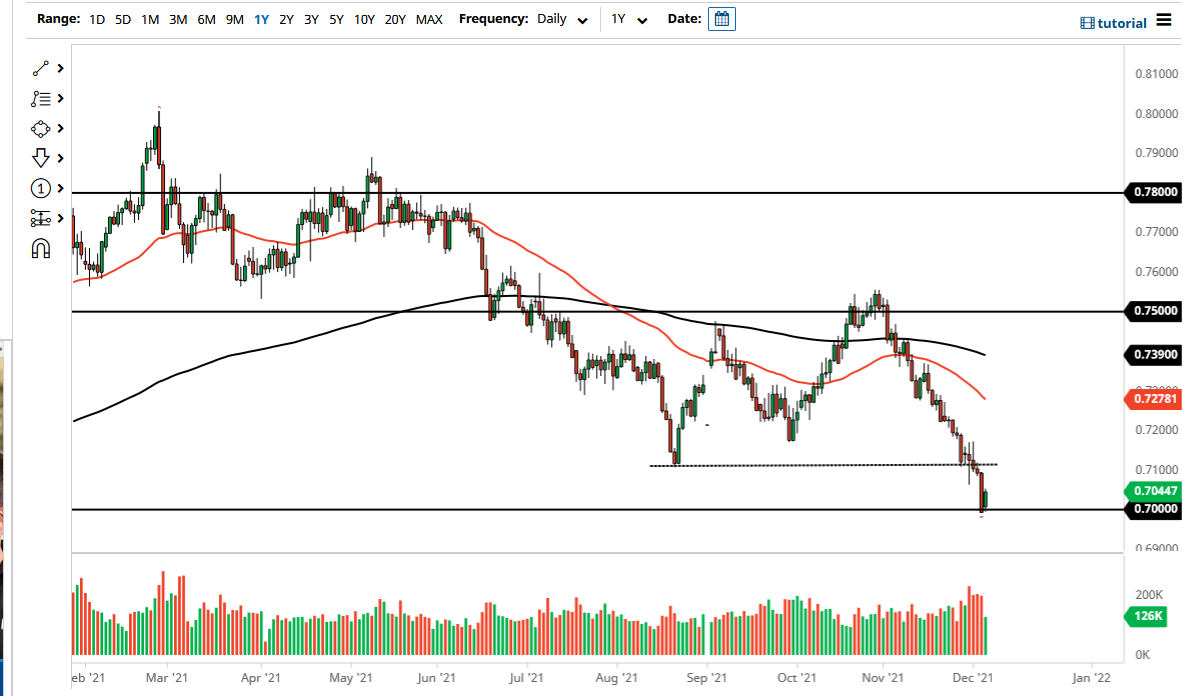

The Australian dollar bounced a bit on Monday to kick off the week on the right foot. The 0.70 level has offered a certain amount of support at this point, which is to be expected considering it is such a large, round, psychologically significant figure. The 0.70 level will attract a lot of attention, but to the upside I think we have plenty of resistance that we need to pay close attention to.

To the upside, the market is likely to continue to see the area right around 0.7150 as significant resistance, as we heard a lot of noise in this general vicinity a couple of weeks ago, so it is likely that we would see a bit of a short-term ceiling in that area. If we can see any type of significant selling in that area, I will start to short this market. A long wick to the upside on a daily candlestick would be a great opportunity to start selling again. However, if we were to turn around and break above the 0.72 handle, then it is likely that the market could go looking towards the 0.73 level after that, and when you look at this chart you could even draw a trend line from the previous channel that could cause significant pressure.

On the other hand, we may simply roll over. If we do and break down below the 0.70 level, then it is likely that we go looking towards the 0.68 handle, an area that has been important more than once. The 0.68 level has been a major area of noise over the years, so it would make a certain amount of sense that we revisit it. This will be especially true if the US dollar continues to strengthen in general. Nonetheless, this is a market that has plenty of noise attached to it, especially considering that the Aussie dollar is getting hammered due to the coronavirus numbers, and the fact that the Aussie dollar is so highly levered to China has a lot to do with what happens next as well. Regardless, the market has been oversold so I think the bounce that we are seeing is something that had to happen. Pay attention to the US Dollar Index, because it could give you a bit of a “heads up” as this market starts to turn around.