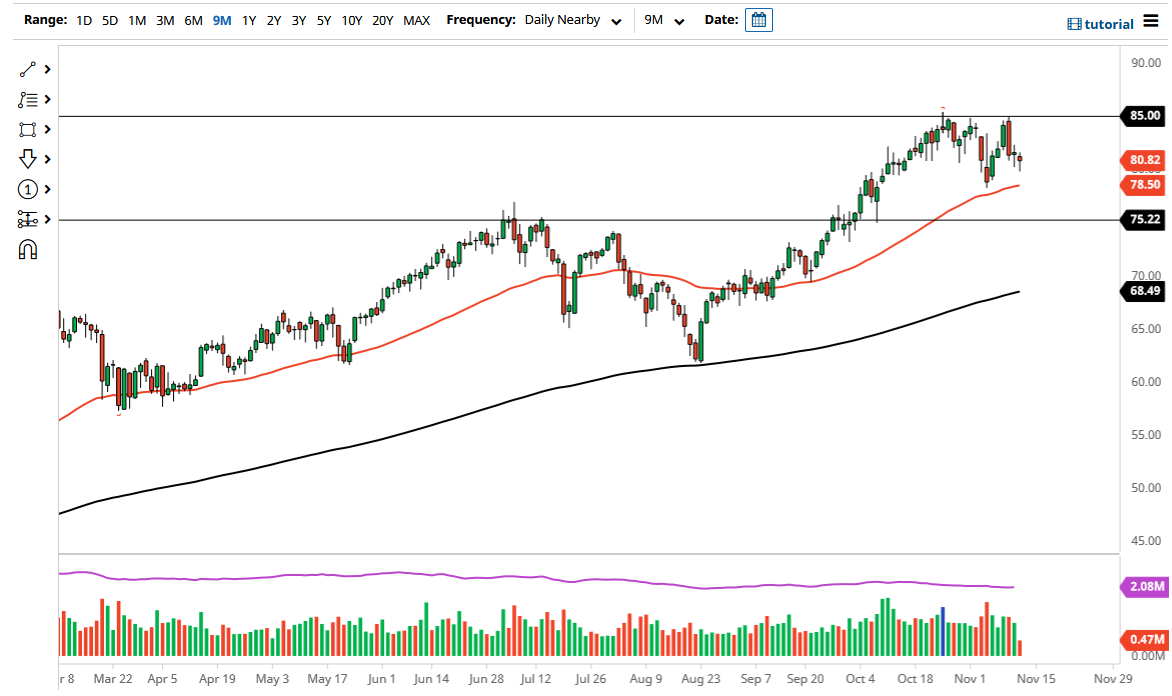

The West Texas Intermediate Crude Oil market pulled back just a bit on Friday as we continue to build up a little bit of a base at this point. We are forming a bit of a bullish flag-shaped candlestick, and it is likely that we could turn around and go higher. The $85 level above would be a massive barrier that is going to be difficult to take out, so if and when we do, that would show an extreme amount of strength.

To the downside, if we were to break down below the 50-day EMA, is likely that we could go looking towards the $75 region. The $75 region has a certain amount of psychology involved with it, and the fact that the $75 region was a previous high is significant as well. There should be a bit of “market memory” in that area, so I think it will serve as a bit of a floor in the market. As long as we stay above there, I will continue to look at short-term pullbacks as buying opportunities.

If we do break out above the $85 level, then you have to take the “measured move” of the bullish flag into account, which means that we could go as high as $100. I think that is something that will take some time to get to, but it is a potential longer-term scenario. The market will continue to show plenty of noisy behavior, but at this point in time I think that the bullish pressure will eventually return due to the fact that there is a major supply issue. OPEC has shown no proclivity to pump out more supply, despite the fact that the Biden administration has been pressuring them to do so. The markets are going to have to price in the fact that the entire world is waking up, meaning that the demand for crude oil will continue to rise, right along with the idea of a lack of supply not only due to a sudden surge in demand, but also the fact that so much production had been lost during the pandemic. With this, we continue to see more movement to the upside, and I think we will get a continued “buy on the dips” attitude on short-term charts, until we can finally break the ceiling above.