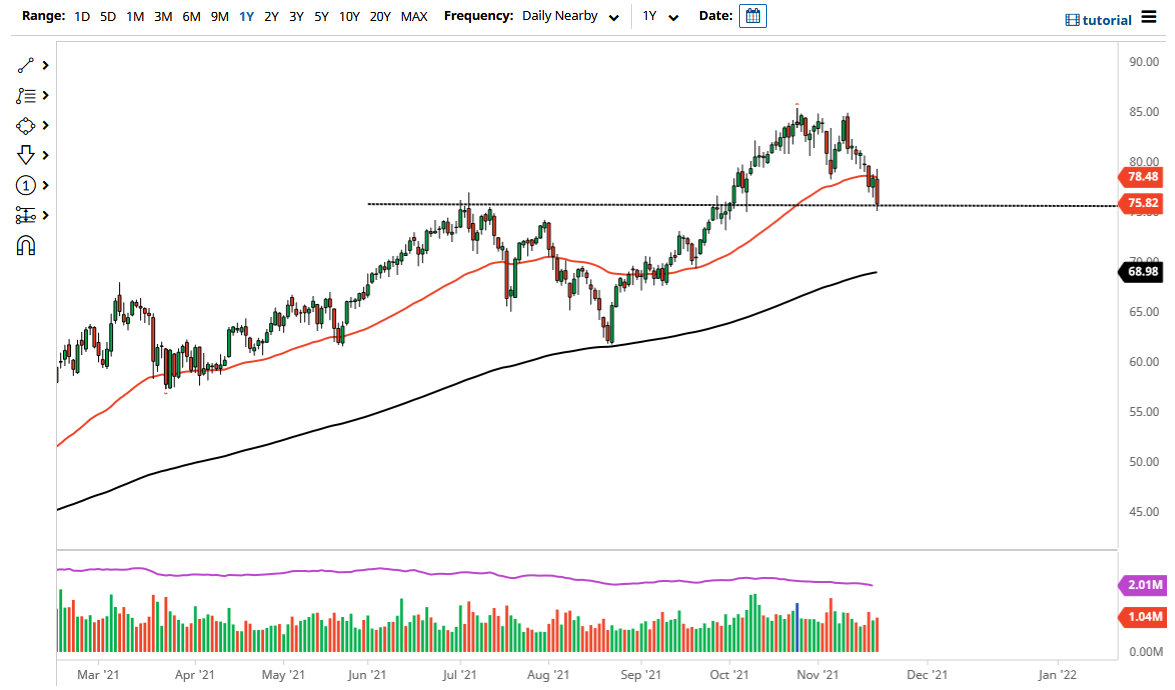

The West Texas Intermediate Crude Oil market initially rallied a bit on Friday but then rolled over to show signs of weakness. As we slammed into the $75.50 level, it does make sense that there would be buyers in that area due to the fact that it was the area of resistance previously. In other words, a certain amount of “market memory” comes into play at that region. I think that as you see the oil market pull back, you should be thinking about is whether or not it offers value. It currently seems to be, so I like the idea of picking up some type of supportive or impulsive candlestick to the upside.

Currently, it is very likely that we will continue to see a lot of noisy behavior, but at this point in time it is a situation where if you are patient enough, you should get a nice opportunity to get long in a market that is longer-term bullish. Yes, there are a lot of concerns about the Strategic Petroleum Reserve being released, but at the end of the day, we have already priced in that possibility as we pulled back to $10 per barrel. The market now has to think about the idea of Austria locking down, but perhaps more importantly whether or not Germany well. If there are more lockdowns in the European Union, then it does make sense that we would see selling pressure due to the fact that demand will drop.

I do not think this is going to be the case, so it is more than likely only going to be yet another opportunity to buy oil “on the cheap.” Looking at this chart, it is very likely that we could see quite a bit of noisy behavior today, but if we see some type of confirmation that Germany is in fact not going to lock down, I suspect that we will start to see a little bit of a recovery at that point. The market had been very bullish for some time, so a pullback at this juncture makes sense, as it simply allows those who have missed out on the rally to get involved again. I have no interest in shorting this market anytime soon.