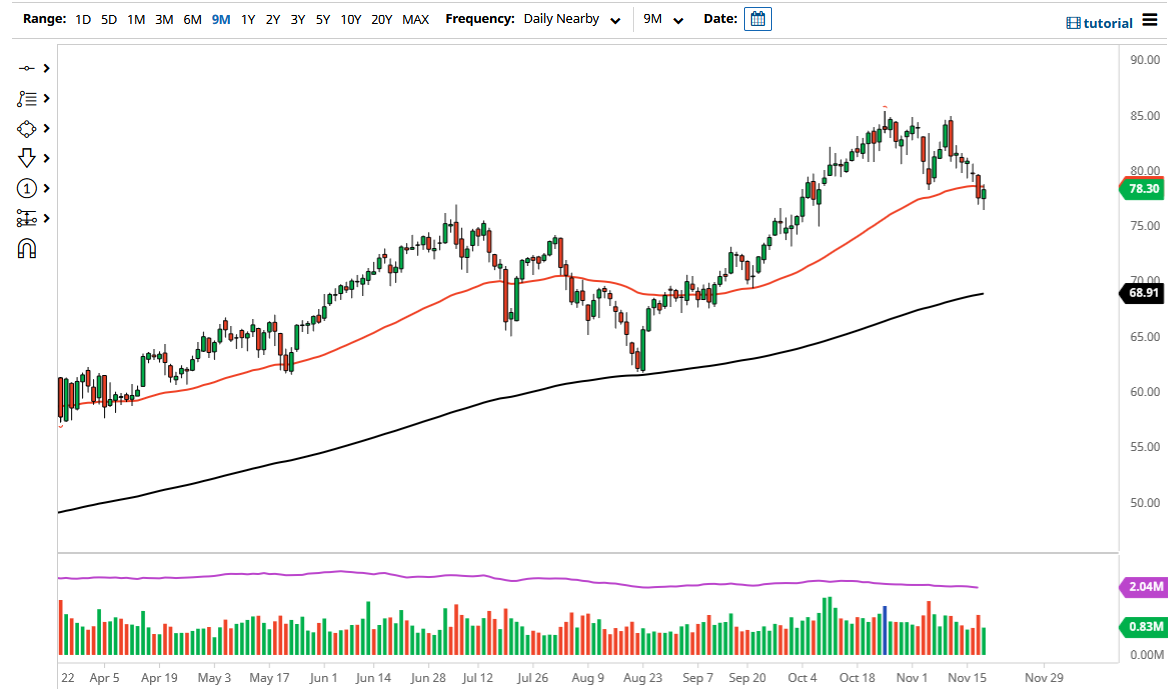

The West Texas Intermediate Crude Oil market has broken down a bit during the course of the session on Thursday but has seen a bit of buying pressure to test the 50 day EMA. The market is forming a bit of a hammer, and now that we have had a nice pullback, it does make a certain amount of sense that we would see this market continue to go higher. At that point, it is likely that the market would go looking towards the $85 level, which is where we had recently formed a bit of a “double top” previously. I think the $85 level is more likely than not going to be the target, and I do not think that it will be easy to break above.

On the other hand, if we were to break down below the bottom of the hammer for the trading session on Thursday, then it opens up a move down to the $75 level. That is an area that I think has a lot of psychology attached to it, and therefore I think I would be a bit surprised to see this market break down below there. Even if it did, the 200 day EMA is reaching towards the $70 level as well, so I think that is your “floor the market” going forward. Nonetheless, we have formed a nice hammer for the day, and this does suggest that the buyers are trying to step up and pick this market up. If that is going to be the case, then it is probably only a matter of time, or we turn around and go looking towards the $85 level above.

Looking at this chart, this is a market that will continue to be very noisy, but you should keep in mind that we are in an uptrend. That is probably the most important thing here to pay attention to, so because of this you need to keep the “buy on the dips” type of set up in mind, as trying to short a market that has been so strong for months on end would be rather foolish and probably a great way to lose money. If we can somehow break above the $85 level, then it is likely that we could go much higher, perhaps filling the idea of a $100 target.