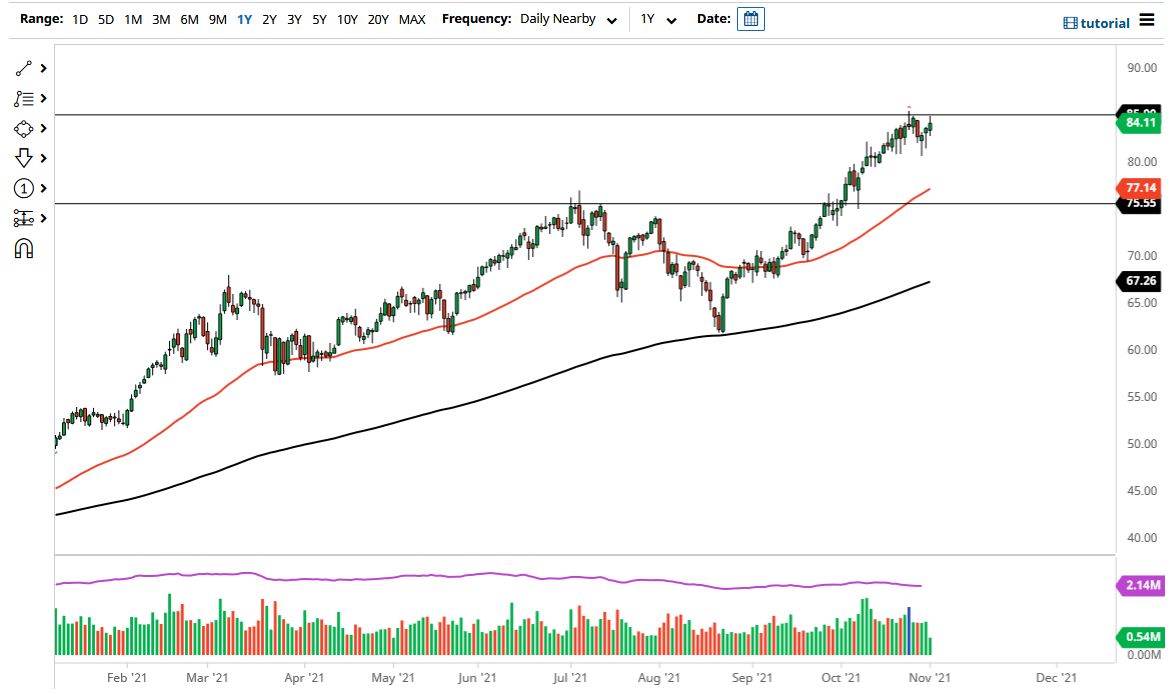

The West Texas Intermediate Crude Oil market rallied a bit on Monday, trying to take out the $85 level, an area that would attract a certain amount of psychological attention. The $85 level has recently been resistance, so taking out the shooting star from last week would be a very bullish sign, opening up the possibility of further gains. Oil is a market that is a very strong uptrend, and I do not see how that will change anytime soon as we have been stuck in the reopening trade for quite some time.

We continue to see plenty of noisy behavior, but the demand for crude oil will only pick up due to the fact that the capital expenditure in this sector has not been up to par during the pandemic, and the fact that the world is trying to “go green.” At this point it is difficult to imagine a scenario where crude oil would suddenly lose strength, due to the fact that there is a massive reopening trade going on, which suggests that there will be a lot of need for energy. Furthermore, some of the other forms of energy have been so expensive that it makes sense that oil will continue to go higher. After all, energy producers have had to switch over to crude oil in order to heat homes, drive electrical plants, etc.

OPEC has no interest whatsoever in trying to increase production, and that will continue to weigh upon the idea of supply and demand. This is a market that has been in a huge move to the upside for a while, and I think that will continue to be the case going forward. The US dollar falling has helped the crude oil market as well, so I think you need to be very sensitive to the US Dollar Index, as it tends to have a negative correlation over the longer term. With that being said, I am bullish, but I also recognize that we have a little bit of work ahead of us, especially with the jobs number coming on Friday from the United States. Nonetheless, the directionality of this market is most certainly upwards.