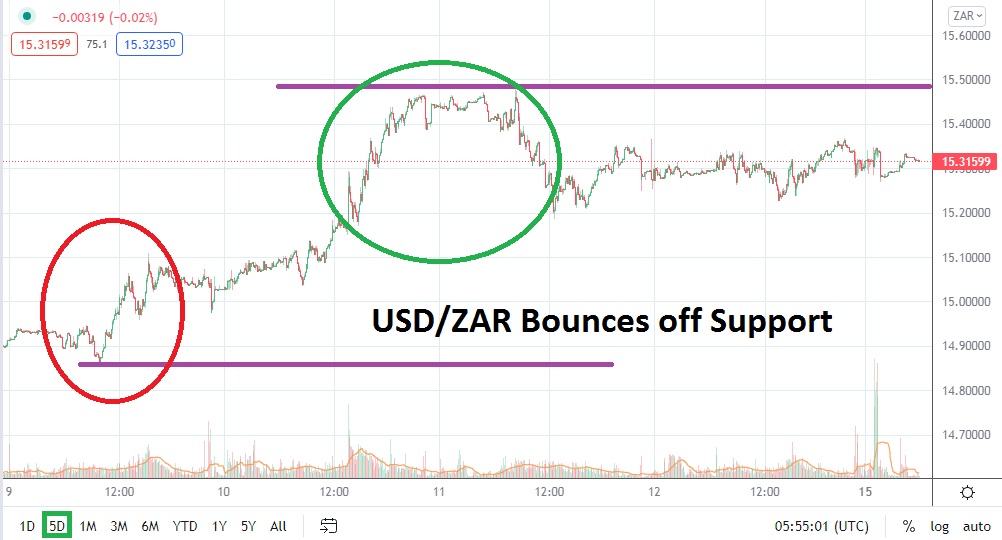

As the USD/ZAR begins trading this week the Forex pair has been able to sustain its higher short-term realm since bouncing off strong support levels last week. As of this writing, the USD/ZAR is near the 15.30000 ratio and rather interesting support persist near the 15.27000 to 15.25000 levels. While looking above, resistance seems to be near the 15.37000 mark. The question for short-term speculators is where the next cycle of trading within the USD/ZAR will move towards and a choice needs to be made.

The USD/ZAR has proven choppy for speculators and financial houses alike the past month. Global Forex results have been difficult to trade for a wide spectrum of market participants and many technical and fundamental techniques have faced challenges as important central banks and their treasuries have created nervous sentiment. The USD/ZAR was trading within sight of the 15.50000 level on the 3rd of November, then reversed lower and hit the 14.86000 mark on the 9th of November which is where support then ignited another run higher.

The USD/ZAR hit the 15.48500 ratio on the 11th of November and then declined to the 15.19000 later in the same day. Intriguingly, the USD/ZAR had another day of trading before going into the weekend and on the 12th touched a high near 15.36000 and produced a low of 15. 22000. This little piece of evidence suggests the USD/ZAR was not able to break the low seen on the 11th and its move upwards in the short term might be able to be sustained.

The USD/ZAR is near a rather solid inflection point regarding the 15.30000 value. If the USD/ZAR is able to maintain support levels near or slightly below this mark there is enough speculative technical information that suggests another move upwards could be produced which will test resistance levels. Traders, however, should not get overly ambitious and remember the choppy results Forex has produced the past month on a nearly weekly basis.

Traders may want to wager on buying positions which seek nearby resistance targets using tactical take profit and stop loss orders which work to ‘cash out’ positions which have hit their goals. The USD/ZAR appears to be headed for a rather turbulent week of trading as nervous sentiment remains strong in the global markets.

South African Rand Short-Term Outlook

Current Resistance: 15.37000

Current Support: 15.26900

High Target: 15.46900

Low Target: 15.17000