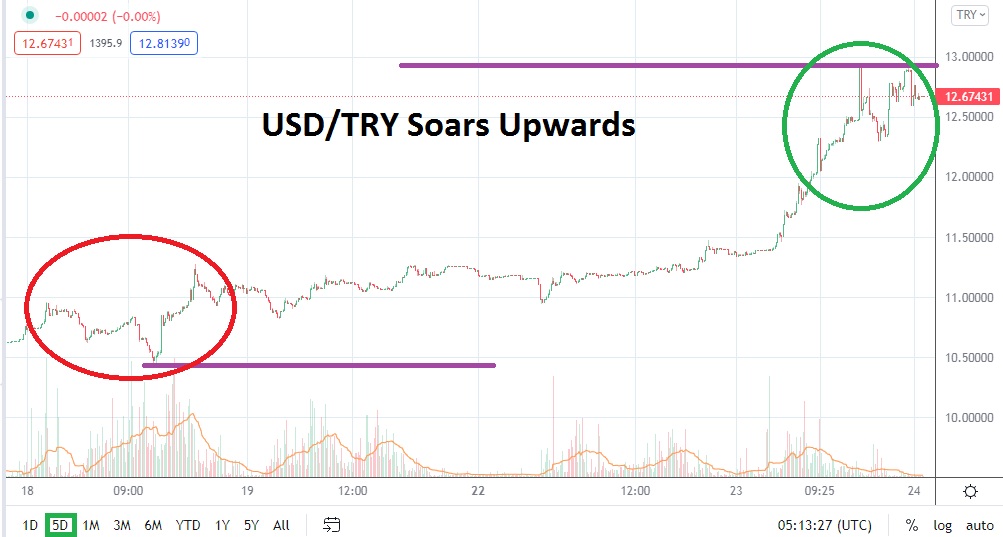

Technical traders have a lot to look at today regarding the USD/TRY, as the Forex pair generates all-time highs; this comes as fundamental questions regarding the value of the Turkish lira is steered by Turkish leader Erdogan rather bizarrely. Traders should proceed with their chart inquiries. Record highs were made by the USD/TRY yesterday and in early trading today, values have pushed towards these apex junctures again.

The central bank of Turkey cut its interest rate last week even as evidence clearly shows inflation is soaring in Turkey. The reason for the reduced borrowing costs is likely because of pressure being exerted by Turkish leader Erdogan on hand picked advisors who are ‘in charge’ at the Central Bank of the Republic of Turkey. It appears Erdogan is intent on trying to ‘will’ his beliefs regarding inflation and the loss of value in the Turkish lira into reality, because his ego cannot accept what everyone else knows. Global financial institutions are not working for Mr. Erdogan and continue to doubt his economic policies.

Traders this morning who wake up and feel speculative, read the news surrounding the USD/TRY may believe now is the time to try a day trade of the Forex pair. However, trying to find a Forex broker who will allow you to trade the USD/TRY short term may prove a difficult endeavor.

It has been reported that some brokers suspended trading of the pair for retail clients yesterday due to the volatility. On the 18th of November the USD/TRY the value of the pair was near 10.45000. As of this writing the USD/TRY is near 13.00000.

If a trader can get into the USD/TRY they should use strict entry levels and not allow for any slippage. The trader should also ask what the transaction fee and overnight costs are for the Forex pair, because the fees may have been changed due to the volatility.

Buying the USD/TRY on any moves lower to support levels appears to be the correct wager at this moment. If the USD/TRY ‘slips’ to around the 12.75000 ratio today, buyers may believe support near the 12.25000 could remain firm and that a test of yesterday’s highs will be demonstrated sooner rather than later. The thought the USD/TRY could hit 13.25000 is not far-fetched.

Turkish Lira Short-Term Outlook

Current Resistance: 13.10000

Current Support: 12.75000

High Target: 13.30000

Low Target: 12.24000