The recent record US inflation numbers have increased market expectations that the US Federal Reserve may surprise everyone by announcing an increase in US interest rates at any time, especially since it has already reduced its purchases of bonds. Accordingly, the USD/JPY currency pair made a bullish comeback, with gains that pushed it to the 114.30 resistance level at the end of last week's trading, near its highest level in more than three years, and closed trading around the 113.92 resistance level. Overall, the US dollar was the top performing major currency last month and last week, but it looks high at current levels and the Forex analysts at Crédit Agricole expect it to "stop in its tracks".

The dollar's rally gained momentum in mid-trading last week when it was revealed that US inflation had reached a 30-year high in October, and Valentin Marinov, FX analyst at Credit Agricole said that it rises on the back of stronger-than-expected US inflation and employment data in recent days.

Marinov attributes some of the dollar's recent strength to Federal Reserve Chair Jerome Powell's comments that high US inflation is his top priority, leading to faster and more aggressive Fed policy repricing in the coming quarters. In the face of high inflation, the Fed could speed up the pace of "cutting" quantitative easing, which means it will end early and the possibility of a first rate hike is close. Credit Agricole argues that the US dollar may attract support from international investors who see it as a hedge against inflation seeking to "protect against the devaluation policies of many of the G10 central banks at present and the detrimental effect they are having on their fiat currencies".

However, regarding the future outlook for the dollar, many of these ideas are now well understood by the market.

Credit Agricole analysts add, “We doubt that the Fed will be able to meet the already hawkish market expectations and abandon its 'patient' view on rates before we see further improvement from the US employment data. This could keep US real rates and yields very negative and ultimately keep the recent US dollar rally on track.”

The most recent appreciation of the US currency was, as Crédit Agricole described it, "overbought and overvalued".

However, the dollar's bullish trend appears to be well entrenched, and calling for a U-turn is a risky proposition. Anders Eklöf, a strategist at Swedbank, says the dollar will rise thanks to strong economic growth as delta drag fades and positive returns vary against many of the G10 peers providing support. Economists at Swedbank expect the maximum employment and slack in the US labor market to be less than what the Federal Reserve had forecast.

“If that is the case, prices will need to be raised sooner rather than later and the US dollar will benefit,” Ekloff adds.

Bank of America interprets the action following the Fed's November calls as compliant with the Forex market that still sees the Fed want to run a hot economy.

Technical Analysis

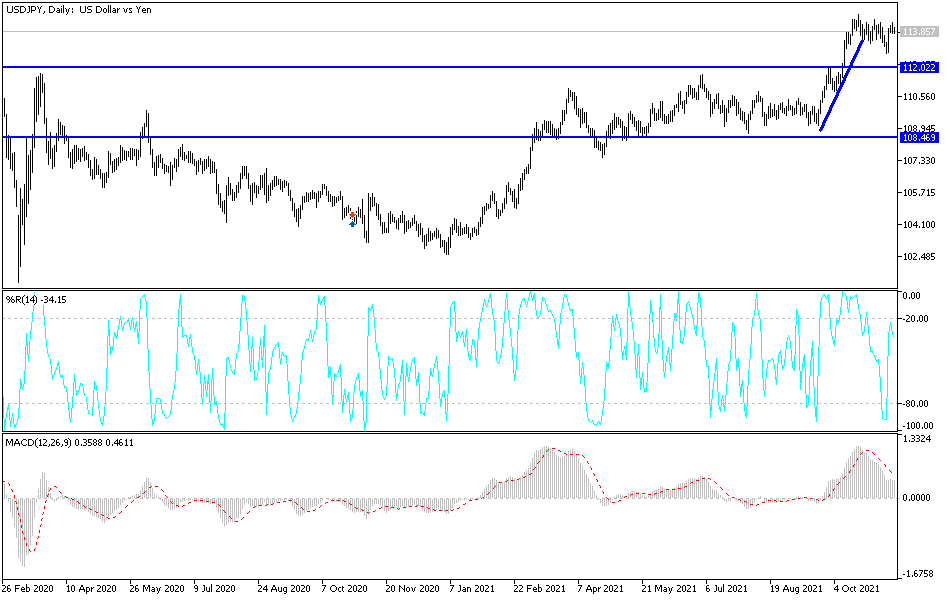

So far, the general trend of the USD/JPY currency pair is still bullish, and stability above the 114.00 resistance motivates the bulls to advance further, with the next ascending targets likely to be 114.55, 115.20 and 116.00. The latter would push technical indicators oversold levels. US retail sales and intense rhetoric from many US monetary policy officials this week will shape investors' sentiment towards the US dollar's recent gains.

On the downside, there will be no reversal of the general trend of the USD/JPY pair without breaching the 112.00 support. Otherwise, the general trend will remain to bearish.