For the third day in a row, the USD/JPY is settling below the 113.00 support level after strong selloffs which the pair recently witnessed as it collapsed from its highest level in six years, when it tested the 115.52 resistance level last week. The outbreak of a new variant of the Corona virus, which contributed to the return of lockdowns, disturbed investors and markets, and it may also be with global central banks that are heading towards tightening their monetary policy. This morning, the currency pair attempted to correct upwards to reach the 113.88 resistance level, but it came back down, settling around the 113.10 support level at the time of writing the analysis.

FX markets have generally calmed since the start of this week's trading, despite mixed omicron anxiety that dominated international headlines. Currently, investors seem to adopt a wait-and-see approach to investing.

Market analysts are still forecasting fluctuations in the currencies' performance. “Until then, market volatility is likely to remain elevated,” said Rodrigo Cattrell, senior FX analyst at National Australia Bank, in a note to clients. “Markets have had to reassess the global growth outlook until we know more. ”

Global financial markets will be watching US President Joe Biden's speech when he provides an update on America's response to the new variant. Although the World Health Organization (WHO) has urged everyone to avoid a sudden reaction, officials have reacted by closing borders and suspending travel to and from major destinations. Meanwhile, investors will be paying close attention to the speeches of several Fed leaders. Fed Chair Jerome Powell and outgoing Fed Vice Chair Richard Clarida will speak and may offer some insights into how the omicron variable could affect the US central bank's monetary policy moving forward.

The US dollar index (DXY), which measures the performance of the US currency against a basket of six major competing currencies, rose to 96.20, and the index suffered a weekly loss last week of 0.3%, but it is still up by 7% since the beginning of the year 2021 to date.

The USDJPY rate may be more sensitive to the ebb and flow of risk appetite in global markets as well as any other insights into the Fed's policy outlook that all of the different Fed rate setters who are set to speak publicly throughout the week may offer. These various speeches will come after Federal Reserve Chairman Jerome Powell's Monday and Tuesday appearance in Congress, and they will all be listened to closely by the market for clues about whether the new virus strain is something that can prevent the Fed from accelerating its tapering easing program. Quantitative bank begins to raise US interest rates.

This comes after the minutes of the Federal Reserve's November meeting last week revealed that some of the bank's policy makers were considering calling for exactly this course of action, which severely affected the currency pair's price.

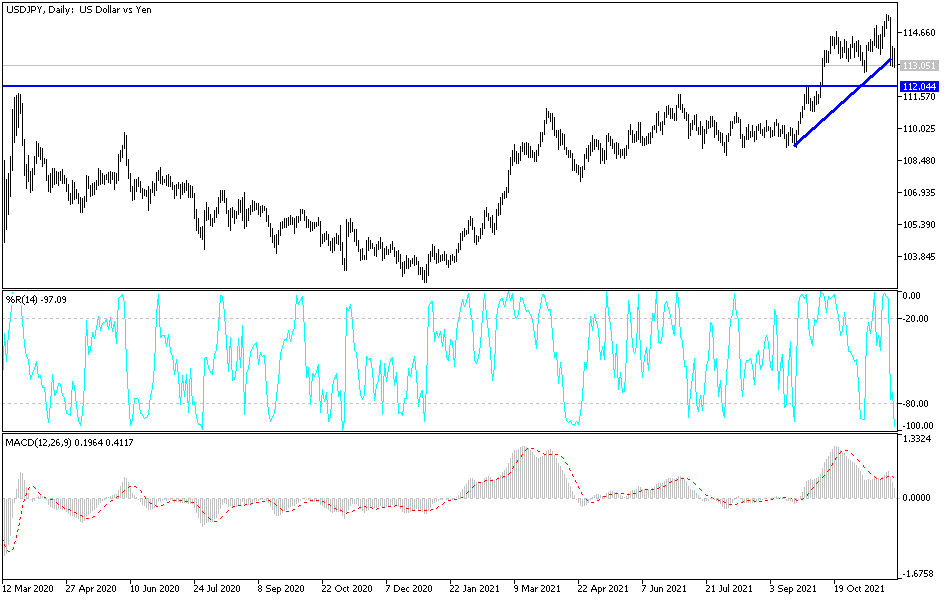

Technical Analysis

On the daily chart, the USD/JPY is stable in an important area. Breaking the 113.00 support supports a bearish reversal of the trend an further movement down. The closest support levels for the pair are currently 112.75, 111.80 and 110.90. On the upside, the bulls will break through the 114.60 resistance to return to the upside track. I still prefer selling the currency pair from every bullish level.

The USD/JPY will be affected today by the announcement of the US consumer confidence reading and the testimony of US Federal Reserve Chairman Jerome Powell.