The US Dollar Index retreated from its highest level in 16 months after hitting a major technical resistance level on the charts. Some analysts warned that a short period of profit-taking may be likely now after the US dollar's gains for four consecutive weeks. This explains the sudden decline in the price of the USD/JPY to the level of 113.93, after sharp gains that affected the 114.96 resistance, the highest in more than three years. The pair is settling around the level of 114.20 as of this writing.

The US dollar's losses were strong despite retail sales data indicating that US consumer spending was already accelerating even before the holiday season opened. The US Dollar Index, which measures the performance of the US currency against six major rival currencies, reached its highest level since July 2020 in overnight trading that witnessed a brief stall above the 50% Fibonacci retracement level before falling below it again.

Analysts are citing recent signals from the European Central Bank (ECB) and Bank of Japan (BoJ) regarding USD gains after both made clear this week that they expect to follow the Fed when it comes makes monetary policy changes. Markets are expecting the Federal Reserve and several other global central banks including the Bank of England to start reversing the interest rate cuts they announced last year at the start of the pandemic until 2022, although the Bank of Japan and the European Central Bank have remained adamant that such expectations are misplaced.

BoJ Governor Haruhiko Kuroda told the media in a speech from the Bank of Japan's Nagoya branch on Monday that the bank would "never consider reversing or abandoning a policy that is too loose" anytime in the near future, and noted that there is not enough inflation pressures yet. Official figures revealed a sharper-than-expected contraction of the world's third-largest economy for the third quarter.

Commenting on this, Jeremy Stretch, FX analyst at CIBC Capital Markets said in a research note on Tuesday, “The physical shortfall in activity comes as Prime Minister Kishida prepares to issue a new fiscal stimulus package. Bank of Japan Governor Kuroda emphasized that it is desirable for foreign currencies to reflect fundamentals that in the context of GDP fail to validate declines in the USD/JPY pair which have proven to be limited.”

The BOJ's position is strengthening the yen's position as the worst performing major currency this year, despite the increasing difficulty in the wake of the European single currency, which hit new lows in 2021 against nearly all of its closest competitors this week. Influenced by European Central Bank President Christine Lagarde's message on the euro, the wind in the dollar's sails put pressure on the EUR/USD pair.

The losses of the euro and the yen were sharp in 2021 and it is a heavy blow to the US Dollar Index, because the two currencies account for just over 70% of market flows measured by the index, despite the increasingly tight market. Expectations of the Federal Reserve's interest rate policy have also fueled investors' appetite for the dollar itself.

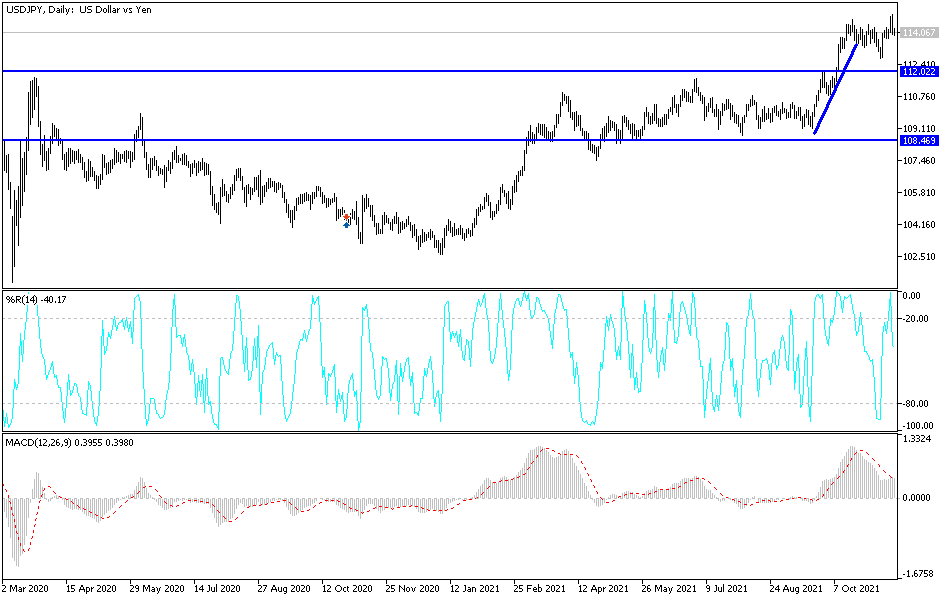

Technical Analysis

Despite the recent sell-offs, the general trend of the USD/JPY currency pair is still bullish, and stability above the 114.00 resistance stimulates a stronger bullish trend. The next targets for the trend are 114.85, 115.20 and 116.00. On the downside, and as I mentioned before, the 112.00 support level will remain crucial for the bears and a change to the current bullish trend. Profit-taking will increase if the dollar does not gain more momentum. Today, the US weekly jobless claims and the Philadelphia Industrial Index reading will be announced.