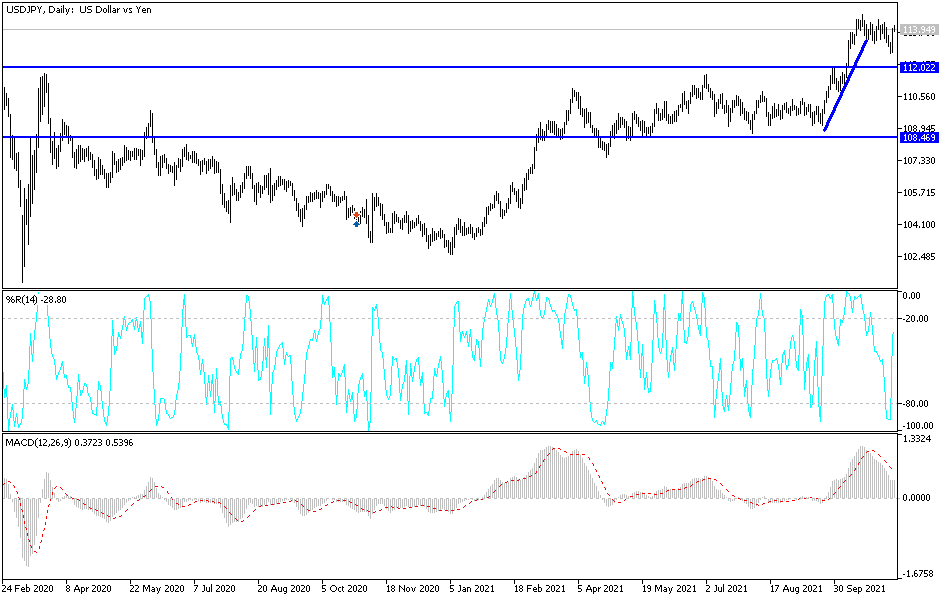

For the second day in a row, the USD/JPY is trying to compensate for its recent sharp losses, which pushed it towards the 112.72 support level, its lowest in a month. The gains of the last rebound pushed it towards the 114.15 resistance level, where it has settled around as of this writing. Those gains were a strong reaction to the rise of US inflation to its highest level since 1990, which increases pressure on the US Federal Reserve policy to accelerate the pace of raising US interest rates.

In addition to the high US inflation figures, the number of Americans filing for unemployment benefits fell to a new pandemic low of 267,000 last week as the labor market recovered from last year's sharp slowdown due to the coronavirus. Yesterday, the Labor Department reported that jobless claims fell by 4,000 in the last week. The four-week average of claims, which moderates the weekly ups and downs, fell by about 7,300 to 278,000, also a low for the pandemic.

Claims for unemployment assistance have fallen steadily since it topped 900,000 in early January and is gradually approaching pre-pandemic levels of about 220,000 per week. The claims, proxy for layoffs, have now subsided for six consecutive weeks.

There were 2.2 million Americans collecting traditional unemployment benefits in the week that ended October 30.

Commenting on the figures, Rubella Faruqi, chief US economist at High Frequency Economics, wrote, "In general, the downward trend in claims continues and the level is approaching pre-pandemic levels." Companies facing labor shortages are more likely to keep workers rather than lay them off.

In general, the US labor market has recovered during the past year-and-a-half. In March and April of 2020, employers cut more than 22 million jobs as governments ordered closures and consumers and workers stayed home as a health precaution. Since then, employers have added more than 18 million jobs - including 531,000 last month - as the rollout of vaccines and government relief programs gave consumers the confidence and cash to resume spending.

Now many companies, struggling to keep up with demand, are complaining about not being able to find workers to fill jobs - a record close to 10.4 million in August. However, the US economy still lacks more than 4 million jobs to where it was in February 2020.

Technical Analysis

A breakout of the 114.00 psychological resistance will warn of a strong upcoming move, and the closest resistance targets for the currency pair are currently 114.65, 115.20 and 116.00. On the other hand, a breakdown of the 112.00 support is important to turn the currency pair's outlook to the downside.

Today is an American holiday that may affect the market's liquidity, but investor sentiment is still affected by the recent US jobs and inflation figures. Forex investors will wait for Fed officials to react to the latest economic figures to anticipate when it is best to tighten its policy.