The US dollar declined at the end of last week's trading as confidence in the financial markets affected the international reserve currency. Despite its tepid performance on Friday, the US dollar is preparing for a weekly increase, maintaining its massive rally since the beginning of the year to date. The USD/JPY reached the 113.30 support level and settled around the 113.60 level at the beginning of this week's trading.

On Friday, it was all about the recovery in the US labor market after the pandemic. According to the Bureau of Labor Statistics (BLS), the US economy created 531,000 new jobs in October, topping market estimates of 450,000. This was well above September's gain of 312,000. The country's unemployment rate fell to 4.6% last month, down from 4.8% in September.

In other work data, the average hourly wage increased 0.4%, the average weekly hours worked decreased to 34.7, and the labor force participation rate was unchanged by 61.6%. Commenting on the figures, Peter Easley, deputy head of the Commonwealth Department of Investment and Research, told CNBC: "The notable increases came from commodity-producing industries such as construction and manufacturing, and it is a sign that the recovery is permeating industries outside sectors of the economy that work from home."

Transportation and commerce also saw solid gains, which could help supply chain bottlenecks ahead of the holiday shopping season. All in all, the job numbers should be seen as a potential development, particularly as the economy continues to distance itself from fiscal and monetary stimulus.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of six major rival currencies, fell 0.07% to 94.28. The index was on track to achieve a weekly jump of 0.16%, to continue its rise since the beginning of the year 2021 to 4.85%.

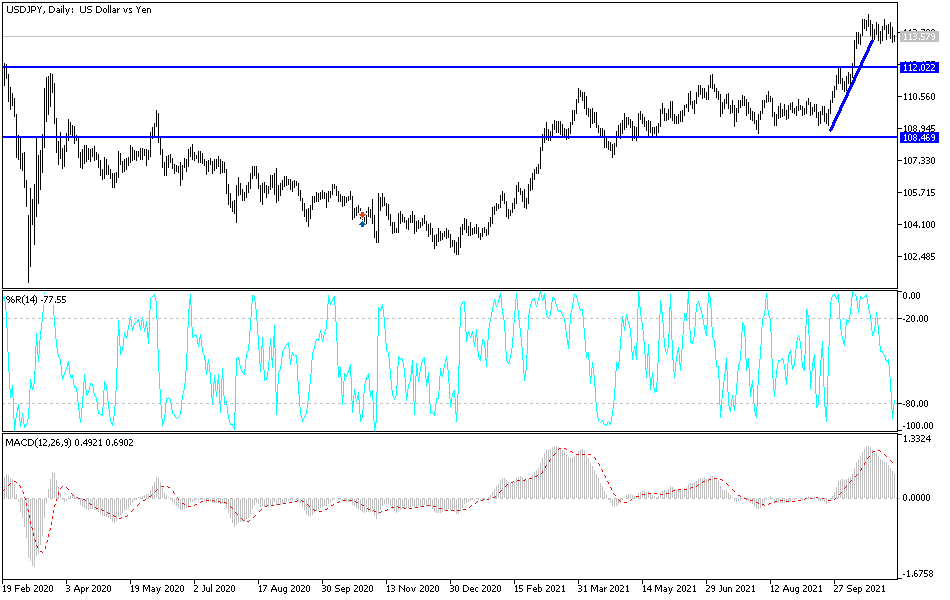

Technical Analysis

The USD/JPY has been trading in a very neutral mode lately, and found support at 113.50, a minor psychological mark, and resistance at 114.25. It appears that the support is holding again, so another movement of resistance may follow. Nevertheless, the 100 SMA is still above the 200 SMA to confirm that the general trend is still bullish and that the support is more likely to hold than to be broken. However, the USD/JPY is trading below both moving averages, so it could hold as dynamic resistance near 114.00.

The stochastic is moving up to show that buyers are in control. The oscillator has plenty of room to go up before reversing the conditions of overbought or exhaustion levels among buyers, so there may be more gains ahead. The RSI is also trending higher, so the price may follow suit while buyers are in control. However, a break below the support level may result in a drop that is at least as high as the range or 75 pips.

The US dollar will be affected today by the statements of US Federal Reserve Chairman Jerome Powell and the statements of a number of US monetary policy officials.