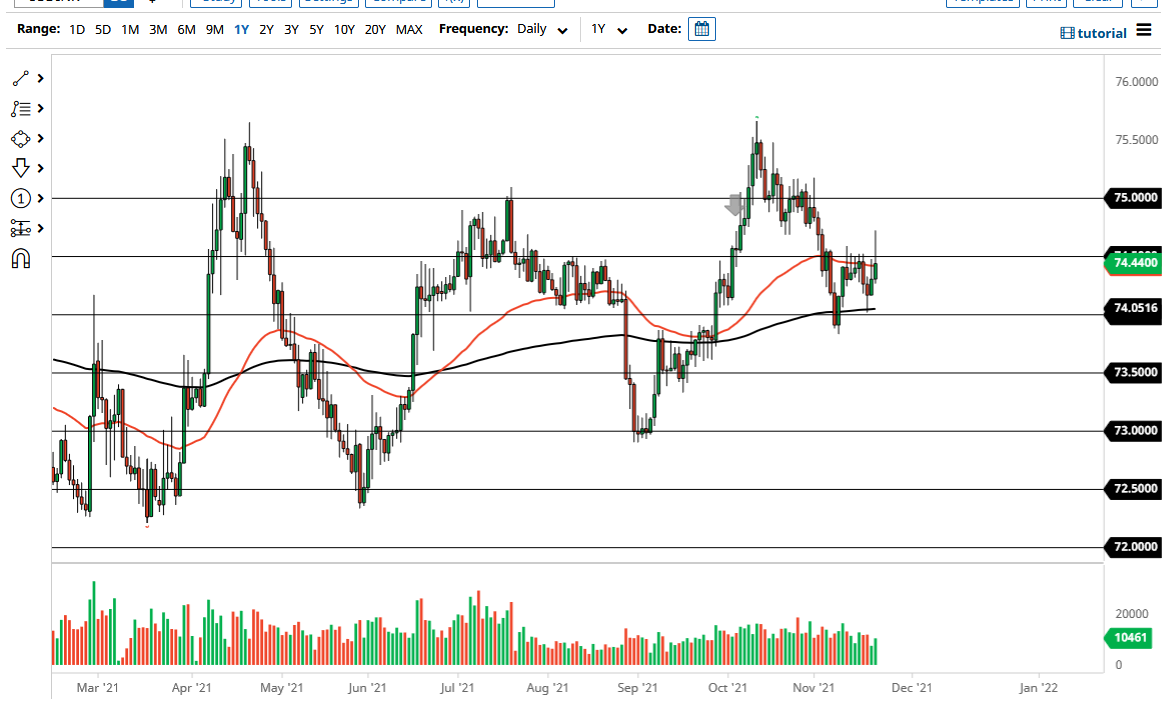

The US dollar rallied a bit on Monday, piercing the ₹74.50 level, but has not been able to sustain the move. That being said, it is only a matter of time before we get another attempt, and if we were to break above the top of the candlestick for the session on Monday, it is very likely it would open up a move towards the ₹75 level over time. Another potential bullish signal would be for the market to close above the ₹74.50 level, even if we did not break out above the top of the candlestick from the session.

It is worth noting that the 50-day EMA sits just below the ₹74.50 level, so I think it is only fair that we continue to look at this as a potential barrier that has been pierced, but not completely broken. Given enough time, it is very likely that we will do so, especially if we continue to see the US dollar strengthening against everything like it has. Alternately, to the downside, we have the 200-day EMA which sits just above the ₹74 level and offers a significant amount of support. The market is highly influenced by the RBI, which has a bit of a peg to the US dollar that it tries to enforce, but at the end of the day the US dollar strengthening will probably relieve some of the pressures in India.

The coronavirus situation could also come back into the picture, but as things stand right now India seems to be doing reasonably well. Certainly, India is not in the same situation that we see in Europe, as Germany and Austria both look likely to lock things down over the next several weeks. That being said, if we see a market move below the recent lows, that could open up a move down to the ₹73.50 level. After all, the USD/INR pair does tend to move in ₹0.50 increments, which as you can see I have marked on the chart. With this being the case, it looks like we are trying to build up enough pressure to finally take off, but we just do not have it quite yet. If the US dollar continues to be resilient though, it is only a matter of time.