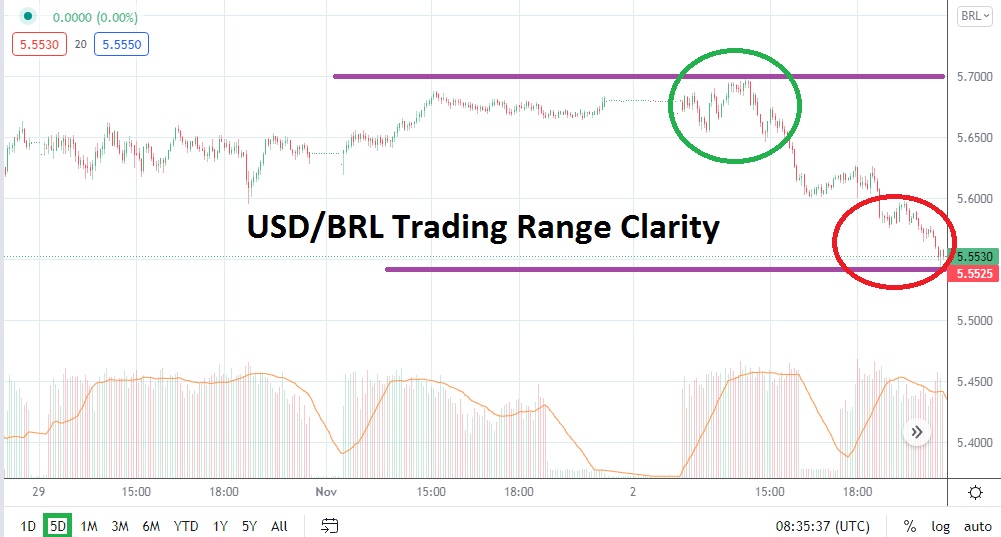

After trading near a high of 5.7000 yesterday, which came within sight of marks made on the 22nd of October that touched the 5.7500 ratio, the USD/BRL began to sell off. The past couple of weeks of trading within the Forex pair have certainly seen technical highs challenged, but the moves have also been a reaction to central bank decisions coming from Brazil and the U.S. regarding monetary policy.

Intriguingly, the technical aspects of the USD/BRL may be producing some clarity and traders could find that speculative opportunities are attractive. After reversing lower yesterday, the USD/BRL will begin its trading near the 5.5500 ratio. Traders should expect some nervous reactions when the pair opens early today, but if the USD/BRL remains near the its current support levels this could ignite technical wagers looking for more downside momentum to occur.

The 5.5200 level appears to be a rather important support level and if it proves vulnerable, the USD/BRL could begin to promptly aim for values below which were traded in the middle of October. The ability of the USD/BRL to penetrate short-term support levels and show price velocity yesterday could add to the notion the pair may have been overbought since late October.

Cautious traders should watch resistance levels above near the 5.5800 to 5.6000 marks; if these junctures prove durable in the near term this could be a signal additional selling momentum will build. Yesterday’s rather fast trading within the USD/BRL may see some additional sparks demonstrated today as financial houses and large commercial traders react. Retail speculators should be prepared for the potential of some early fireworks in the USD/BRL today before conditions calm.

Traders may want to continue to look for downside momentum in the USD/BRL, but they should also keep their targets realistic. It is unlikely the USD/BRL will continue to see a vast amount of price fluctuations like were displayed yesterday. Typically the pair moves in a rather comfortable range and is not a powder keg of volatility, but the USD/BRL does certainly produce surprises and traders need to have their risk management working effectively. If current short-term support ratios are tested near term there is reason to suspect the USD/BRL could find additional bearish momentum.

Brazilian Real Short-Term Outlook

Current Resistance: 5.5900

Current Support: 5.5230

High Target: 5.6600

Low Target: 5.4900