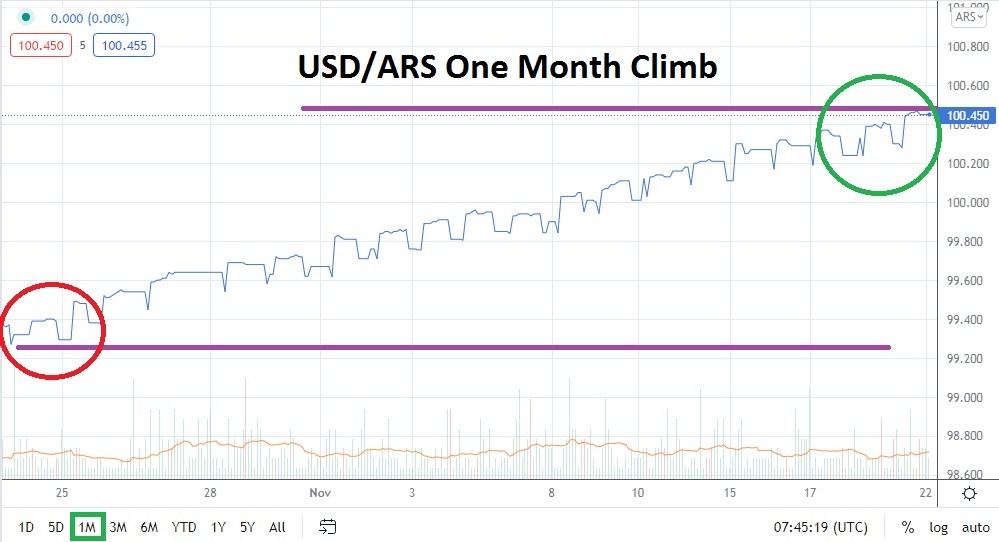

As of this writing, the USD/ARS is trading near the 100.450 realm and its ability to climb above the official exchange rate of 100.000 in the second week of November and sustain its momentum since then should not go unnoticed. There are many interesting points to consider when talking about the rise of the USD/ARS.

First the USD/ARS official exchange rate offered by the Argentine government is nothing like the ‘real’ rate of exchange found on the black market. The Argentine peso can be found within a variety of places trading for almost half its listed value on the street, meaning a rate of around 150.000 can sometimes be transacted discreetly.

Secondly, the ability of the USD/ARS to climb above what should have been a strong psychological ‘horror’ over 100.000 via the official exchange rate caused no panic in the financial markets. This is because no one in any global financial institution, or citizen of Argentina sees the official exchange rate as real. Companies and people are not going out of their way to buy Argentina pesos unless they absolutely need to. Very few people or global entities believe the ruling Argentine government regarding its economic pronouncements and mandates.

A one-month chart has been used here to show the steady loss of value for the Argentine peso, and this is unlikely to change anytime soon. The ability of the USD/ARS to break above the 100.000 mark and comfortably hold its value above the ratio is an indication no one takes the ratio seriously and it has further room to traverse higher.

Traders who have the ability to buy the USD/ARS via their brokers need to check on the cost of the transaction and overnight carrying charges. If a speculator can buy the USD/ARS on their chosen trading platform and manage the transaction costs, taking into consideration the amount of time a trade will need to be conducted to catch another wave higher, the speculative position could prove to be worthwhile. Certainly the USD/ARS could reverse lower for near term, but its long-term direction appears higher and this looks nearly impossible to stop unless a radical change is made by the Argentine government.

Speculating with a buying position of the USD/ARS which is not held overnight is purely a wager. Cautious traders may be tempted to do this to catch the next move higher, but they should enter the market trying to buy on a reversal lower which ignites a long position. It isn’t really a question if the USD/ARS will go upwards, but more a consideration about timeframes and the need to manage the costs of trading the pair which does not eat into the higher moves the USD/ARS is making.

Argentine Peso Short-Term Outlook

Current Resistance: 100.500

Current Support: 100.350

High Target: 100.530

Low Target: 100.200