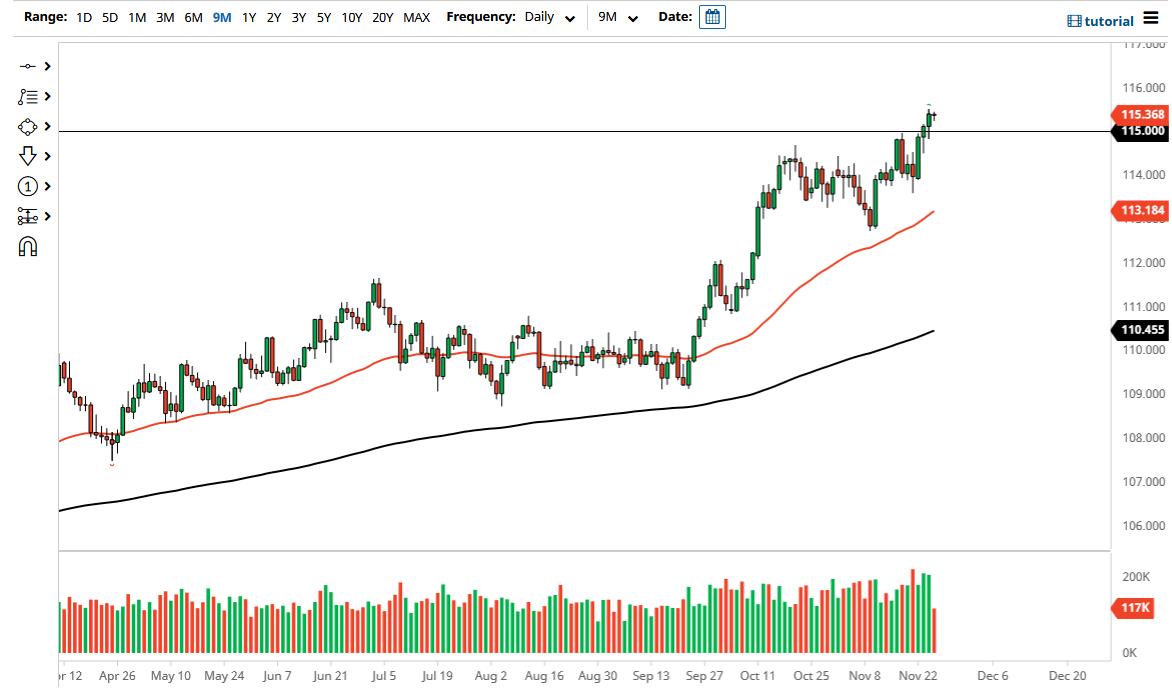

The US dollar has pulled back ever so slightly during the trading session on Thursday, which of course was Thanksgiving in the United States. By pulling back but finding buyers it makes a certain amount of sense that the ¥115 levels is starting to offer support enough to make it look like we are ready to continue going higher. The ¥115 level is a major figure that a lot of traders have been paying attention to over the course of the last several years, so I do like the idea of this being a major potential break out.

The ¥115 level has been massive in its selling pressure in the past, but the market recently breaking out does suggest that we continue to have momentum, and it is worth noting that the last couple of days we have pulled back, only to find buyers again. At this juncture, I believe that this market will continue to attract plenty of buyers, based upon value more than anything else. Furthermore, it should be worth noting that the interest rate differential continues to expand, which favors the greenback in general. As the Federal Reserve has made itself clear that it is going to continue tightening monetary policy, it makes sense that the US dollar would be favored over the yen.

Underneath, the ¥115 level has supportive behavior all the way down to the ¥114 level, which is where the 50 day EMA is likely to go looking towards. At this point, I think it is only a matter of time before we offer more of a “buy-and-hold” situation, and therefore my first target is the ¥117.50 level, which is the next clustering based upon historical charting. After that, then we go looking towards ¥120. It is worth noting that the market does tend to trend for very long periods of time, so not only am I buying the dollar against the yen at this point, but I am also holding on to it. This has become more of an investment than anything else at this point.

If we were to break down below the ¥113 level, then I might consider starting to short this pair, but that seems to be very unlikely at this point. However, if we did break down that significantly, and of course we have seen US dollar weakness across-the-board, I would go ahead and get short.