The S&P 500 fell hard on Friday as we received news that a new variant of coronavirus has hit South Africa. There are concerns about further lockdowns, but quite frankly I think we jumped the gun, and the selloff has been a bit much. Part of what we are looking at is a market that has very little in the way of volume, so it does make sense that we would see an overreaction. After all, Thursday was Thanksgiving, and Friday was a day that most traders probably took off.

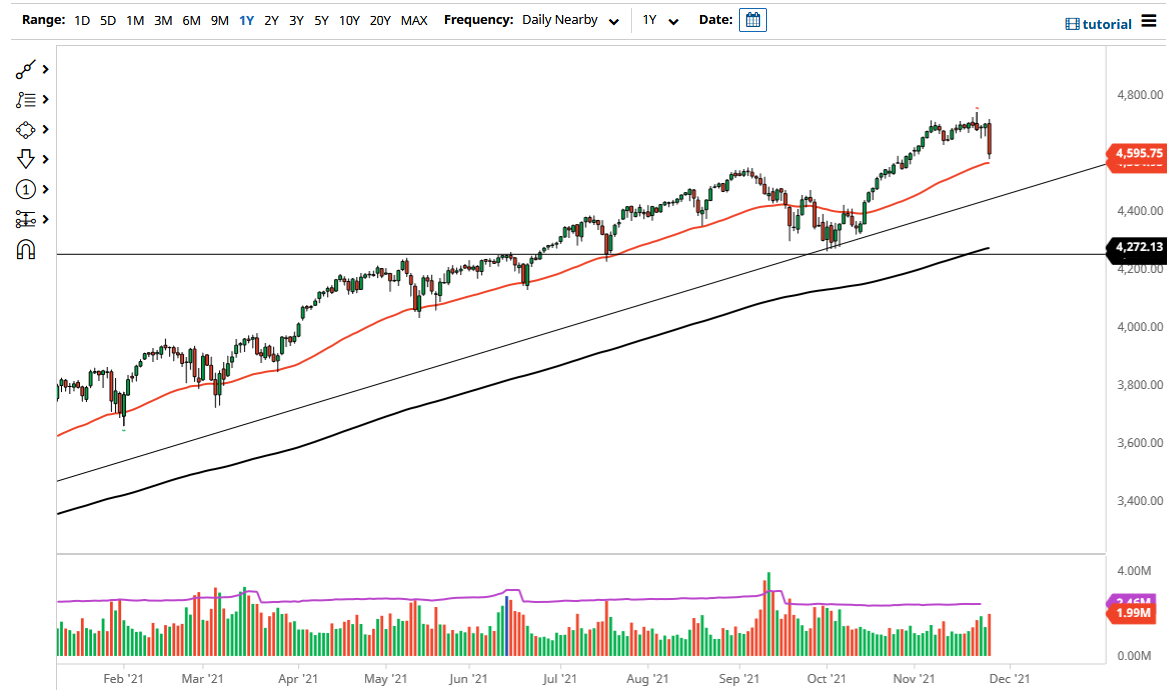

Looking at this chart, I think that we could get a little bit of follow-through, but the 4500 level should be an area into which buyers jump in. After all, the uptrend line sits just below there and a lot of people will be looking to pick up gains towards the end of the year, as they have to catch up on their benchmark. After all, the market is likely to continue seeing a lot of momentum chasing in order to present gains to clients. That being said, it is not necessarily out of the realm of possibility that we will see a little bit more weakness, but I think that is going to be a short-term phenomenon more than anything else.

If we were to break down below the uptrend line, then I might consider buying puts, but until that happens it seems very unlikely that I will be doing so. Furthermore, I think the absolute “bottom in the market” is at the 4250 level, where the 200-day EMA sits just above. While this has been a brutal candlestick on Friday, the reality is that a lot of that has been influence by the fact that it was low volume. The question then becomes how do we behave once we get a significant amount of volume? I believe that you are probably best served sitting on the sidelines and waiting to see how Monday shakes out before putting any money to work. After all, we may see a lot of panic on Monday, but that could disappear rather quickly as well. Ultimately, I still believe we are very much in an uptrend, despite the fact that Friday was so bad. The market lost 2.55%, but at the end of the day we are not that far from all-time highs.