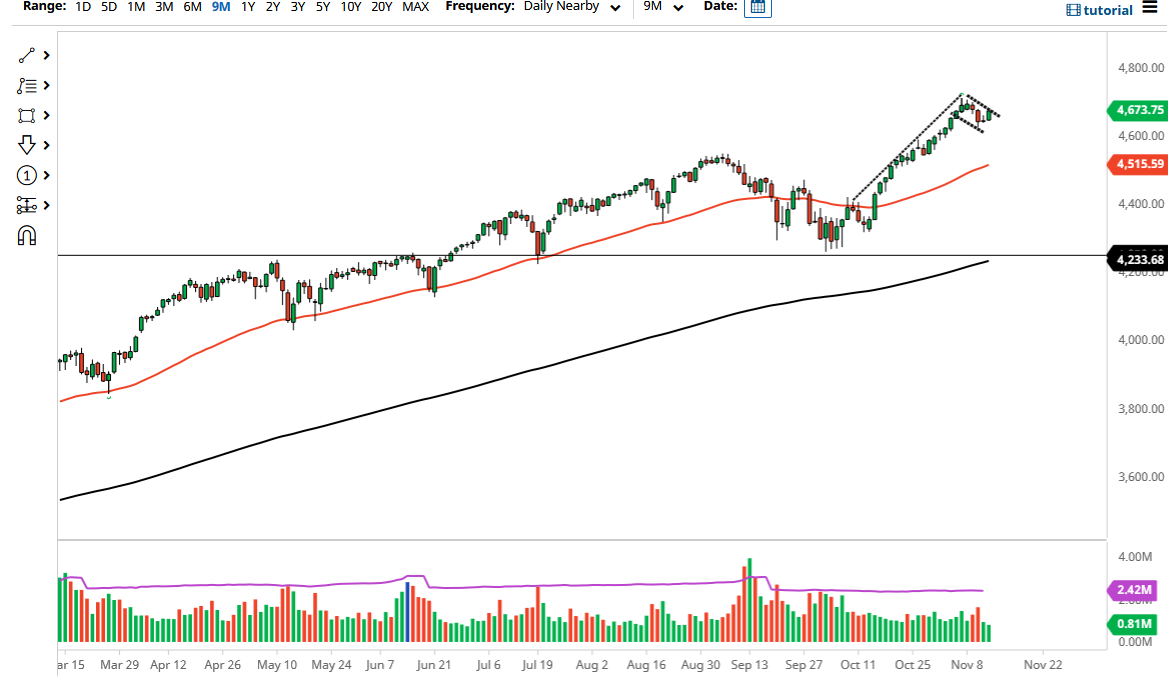

The S&P 500 rallied a bit on Friday, breaking above the highs of the previous session. We are still stuck in a bit of a bullish flag, but it looks as if we are getting ready to break out of it. If we do, then it is very likely that the S&P 500 will go much higher, perhaps as high as 4900 or so. Quite frankly, this bullish flag has been forming for quite some time, and it needed to happen as we had gone straight up in the air for a while.

Looking at this chart, the 50-day EMA is sitting just above the 4500 level and curling higher. This should continue to offer a bit of a psychological floor in the market, and a lot of technical analysis does build itself around the 50-day EMA. Underneath there, we have the 4500 level, and the 4500 level has a lot of psychology built into it as well. With this being the case, think this market continues to be a bit of a “buy on the dips” type of situation, so I will continue to approach it as such.

It is not until we break down below the 4250 level that I would become even remotely bearish on this market, but even at that point I would only be a buyer of puts, because the Federal Reserve is going to stay ultra-loose with its accommodative monetary policy. If we do break down below that level, we would slice through the 200-day EMA, but it would only be a matter of time before Jerome Powell would come out and either say or do something to save Wall Street. The market itself has been very bullish for quite some time, and for the last 13 years, liquidity has been the main driver of the S&P 500.

The market will continue to go higher over the longer term, especially as the earnings season has been relatively positive. Furthermore, as long as we continue to see a lot of momentum, I just do not see how you could short this market. At this point, you are either a buyer, or you are sitting on the sidelines and waiting for yet another buying signal. Ultimately, this is a market that will continue to see plenty of people trying to chase it into the end of the year.