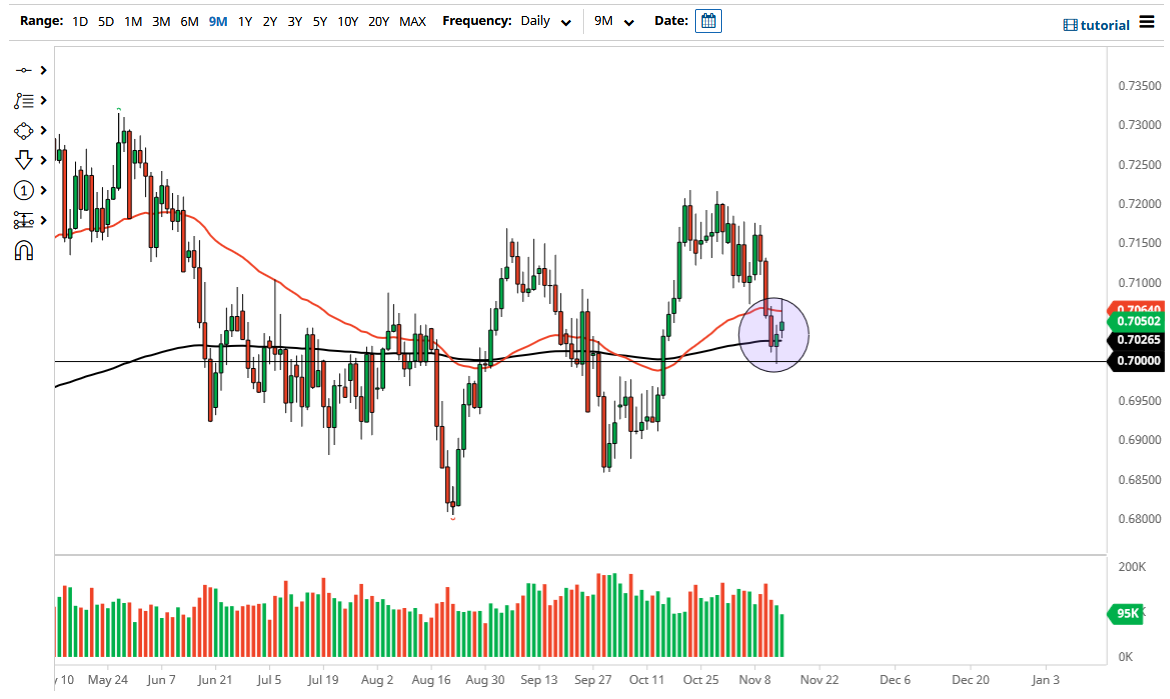

The New Zealand dollar initially rallied a bit on Monday in a very positive sign as we had bounced from the psychologically and structurally important 0.70 level on Friday. However, as we have gone through the day, the market initially popped through the 50-day EMA, only to find plenty of selling pressure. In fact, by the time the afternoon rolled around, the market suddenly looked very exhausted. The candlestick is a bit of a shooting star, so that does suggest more selling pressure. However, it is worth noting that the previous candlestick was a hammer, which suggests that we probably have more choppy behavior ahead.

The market should continue to see a lot of noisy behavior, due to the fact that the New Zealand dollar is highly sensitive to commodity markets and risk appetite. Furthermore, the US dollar is considered to be a major “safety currency”, and I think it has a lot of weight any time the market starts to get scared. The market will follow commodities, as well as stock indices in general. If they all start to sell off a bit, then it is very likely that the New Zealand dollar will go down with them.

Furthermore, you have to recognize that the 0.70 level will offer a certain amount of psychologically important support, so if we do break down below there, I think it will be more of a “trapdoor action” that a lot of people have in the back of their mind. On the other hand, if we turn around and break above the highs of the session on Monday, which is essentially the 0.7080 level, then I think the market will go looking towards the 0.7150 level. It will be noisy, but I think it is a bit of a “binary trade” in the sense that we will break out of this range one direction or the other, and once we do then it is simply a matter of following. The 200-day EMA currently sits at the 0.7029 handle, and I think a lot of people will pay close attention to that as well. Expect a lot of noisy behavior, but we will get this resolved relatively soon.