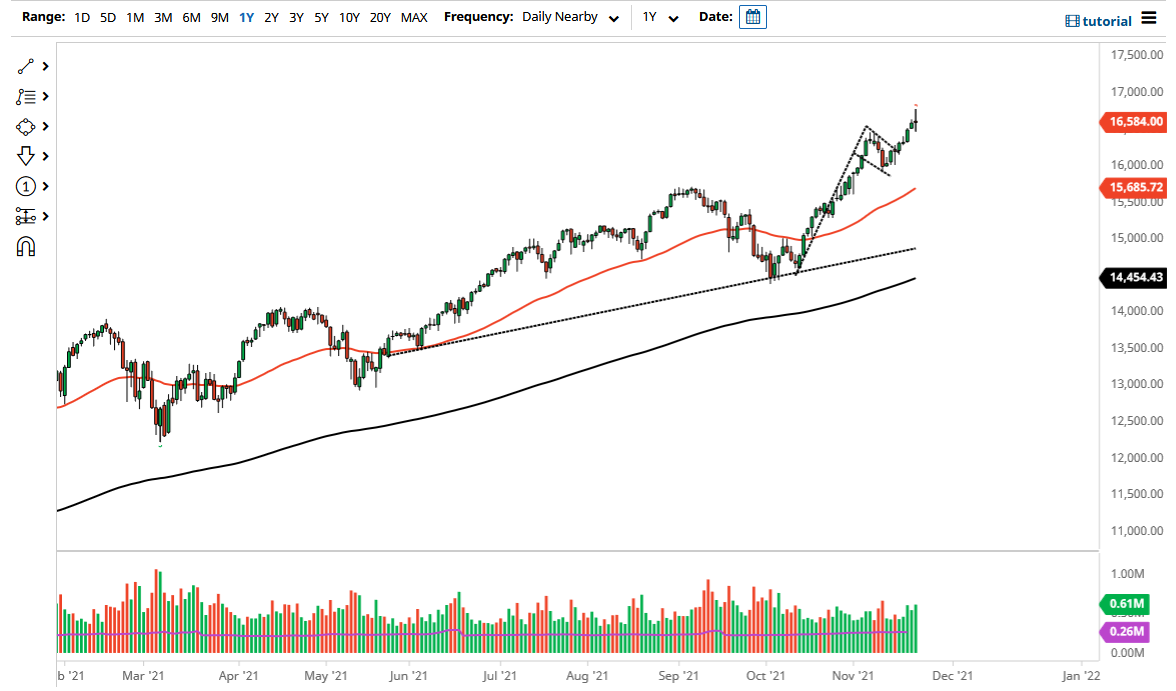

The NASDAQ 100 was all over the place on Monday as we continue to see a lot of volatility overall. When you look at this candlestick, it is easy to see that we have seen a lot of noisy behavior during the day, as we had initially shot straight up to reach a fresh, new high, only to turn around and get slammed in the middle the day. There has been a lot of noise coming out of the bond market, and that has had a massive effect on what has happened here. Ultimately, this is a market that remains “buy on the dips”, as we have been in an uptrend for so long. The market also has formed a bullish flag, which is also part of my thesis for higher pricing.

That being said, we could just turn around and break above the highs which would be yet a fresh, new high, which opens up the possibility of attacking the 17,000 level. Anything above there then allows the market to go much higher. With that being said, I like the idea of taking advantage of any value that we see, and I suspect that somewhere around the 16,000 level there would be a lot of buying pressure if we did drop that far. The 50-day EMA is currently near the 15,700 level and racing towards that region. Ultimately, the market is likely to continue seeing a lot of volatility going into the end of the year, but money managers out there are trying to pad their returns for the year in order to make things look a bit better, as many out there have underperformed their benchmarks.

This is the so-called “Santa Claus rally”, which happens every year. Because of this, I think the market will continue to see plenty of volatility, but there will always be buyers to get involved unless something drastic happens. With interest rates in the US rising, there will be the occasional problem, but in the end, the only thing that matters is momentum, which is exactly what we are currently experiencing. Momentum makes the market go forward, and we certainly seem to have quite a bit of that currently. Based upon the “measured move” of the bullish flag, I still believe we will go looking towards 18,000 before it is all said and done.