The NASDAQ 100 exploded to the upside on Monday, wiping out all of the losses from Friday in a very thin environment during that session. Keep in mind that the market had very few participants during the day on Friday, as it was the day after Thanksgiving and the actual index itself was only open for about half the day. Because of this, a reaction to the noise coming out of South Africa and the variation of the coronavirus was overextended. With that in mind, it makes sense that the market overreached.

On the other hand, when traders came back to work on Monday, they had the knowledge that the South African variant does not seem to be as deadly, so it makes a certain amount of sense that we would see a correction. At this point, the market is wiping out the losses, and it is likely to continue to see upward momentum. After all, this is the time of year when you see the so-called “Santa Claus rally”, when money managers come back into the market in order to catch up to their benchmark. If and when they do, other traders will jump in and take advantage of that knowledge.

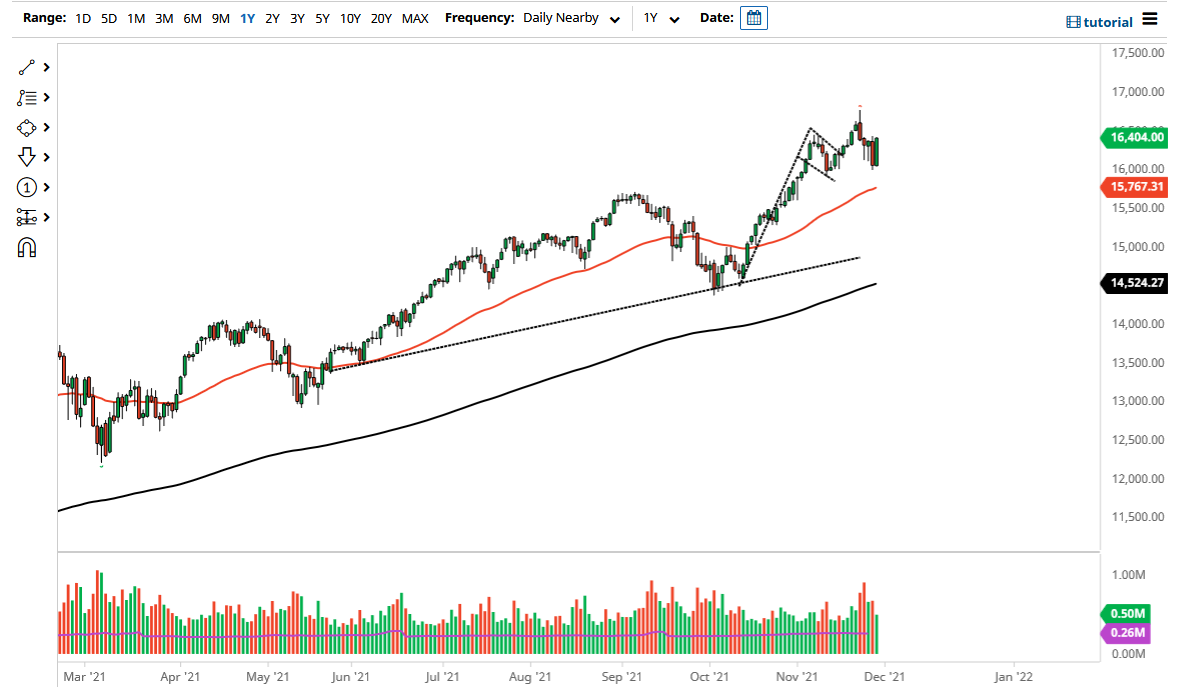

At this point, I do think that we will eventually hit the all-time highs again, which is not that far away. Dips will continue to be bought, and I think by the end of the year we should easily take out the 17,000 level. To the downside, I believe that the 50-day EMA near the 15,750 level makes sense as support, and I think every time we dip it is likely that we will see plenty of interest. In fact, it is not unless we get some type of massive risk-off type of development that I would be concerned with the overall attitude of the market. The NASDAQ 100 is driven by just a handful of companies as you know, so it makes sense that following Facebook, Amazon, and the like is the way to go. As long as those rise, it is almost impossible for the NASDAQ 100 to fall any significant amount. If we do fall, you will see negativity in multiple different markets, not just this one.