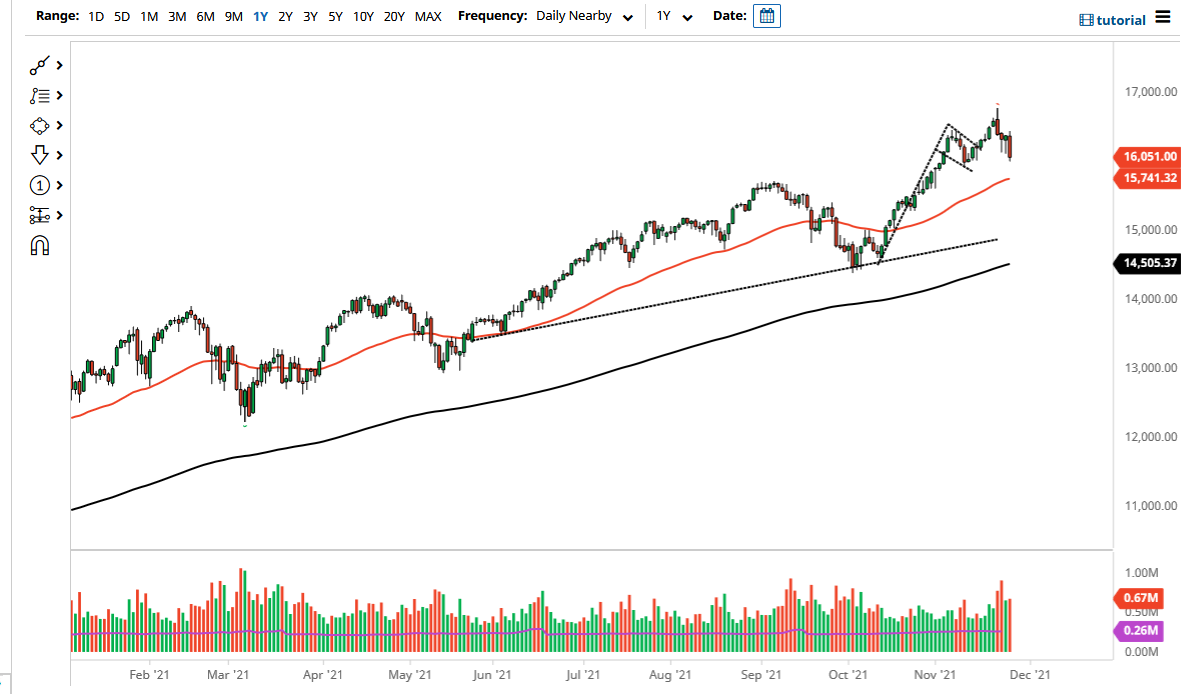

The NASDAQ 100 fell rather hard on Friday in what were limited trading hours. Most of this has to do with the world freaking out about the coronavirus variant being discovered in South Africa, but at this point in time any selloff like this is probably going to be a nice buying opportunity as we have the “Santa Claus rally” this time year, when money managers go chasing returns. After all, they have to report to their clients at the end of the year whether they made money or not, so anybody who is currently running lower than their benchmarks will have to do everything they can to make that up.

The 16,000 level has offered a little bit of support, so I think it is probably likely that today is going to be very interesting. If we do break down from here, I would anticipate that the 50-day EMA could come into the picture, offering a bit of support. On the other hand, if we find out that the variant that is going on in South Africa is not vaccine resistant, we may see this market turn around right away.

More likely than not, it is probably better to sit on the sidelines and wait to find out whether or not this market is going to continue going higher over the longer term, or if we need to correct a bit further. If we do need to correct a bit further, I will simply wait for supportive action underneath to take advantage of. Either way, I have no interest in shorting this index, because US indices are far too manipulated in the sense that there is a massive amount of liquidity being thrown around the market. Yes, we are starting to see the Federal Reserve taper, but that will slow things down, because net over net, they are still increasing their balance sheet. It will be interesting to see this plays out over the next couple of days, but I will be looking for a buying opportunity in a market which, until the last session or so, has found plenty of buyers.