Gold bulls succeeded in grabbing the $1810 resistance as demand for safe-haven assets rose after the dollar fell following data which showed a significant slowdown in US GDP growth in the third quarter. Accordingly, the US Dollar Index fell to 93.28, and the price of gold is stabilizing around the level of $1795 as of this writing, waiting for any news. Silver futures closed lower at $24.120 an ounce, while copper futures settled at $4.4385 a pound.

A report from the Commerce Department showed a significant slowdown in the pace of US economic growth in the third quarter. The report said real GDP rose 2% in the third quarter after jumping 6.7% in the second quarter. Economists expected the pace of GDP growth to slow to 2.7%. Meanwhile, data from the Labor Department showed US initial jobless claims fell for the fourth consecutive week in the week ending October 23, falling to 281,000, a decrease of 10,000 from the previous week's revised figure of 291,000 claims.

Investors also reacted to the policy decisions of central banks. The Bank of Canada on Wednesday ended quantitative easing earlier than expected and suggested the possibility of a rate hike in the middle quarters of 2022. The Bank of Japan maintained its massive monetary stimulus and lowered real GDP growth and consumer inflation expectations. Meanwhile, the European Central Bank left key interest rates and future guidance on asset purchases unchanged, in line with expectations, amid fears of rising inflation.

The bank reiterated that policy makers expect key interest rates to remain "at current or low levels until it sees inflation reach 2 percent long before the end of its forecast horizon and permanently for the rest of the forecast horizon".

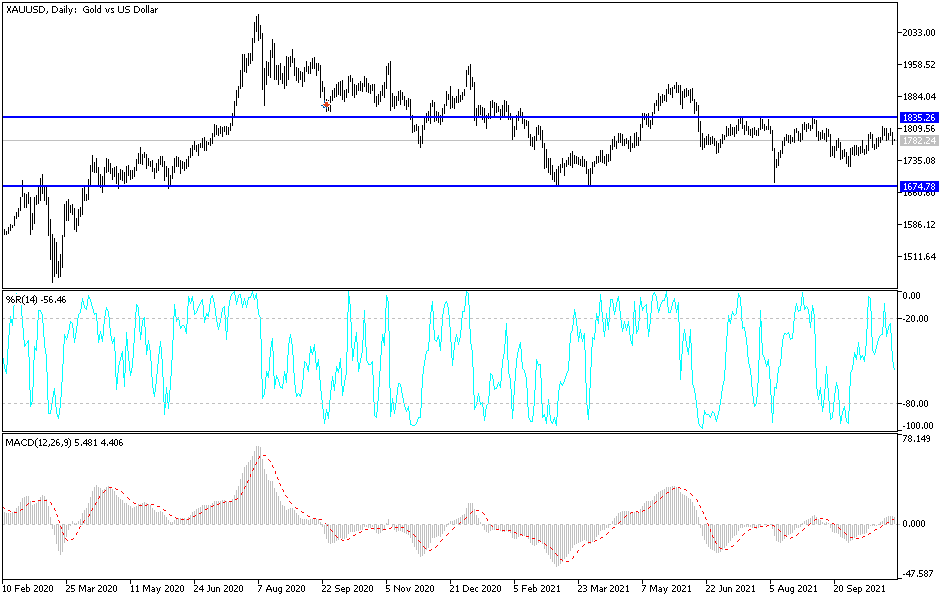

Technical Analysis

Stability above the psychological resistance of $1800 will increase chances of buying, and thus push the price of gold to stronger upward levels, the closest of which are currently $1819, $1827 and $1845. On the other hand, these expectations may be threatened if the price of gold moves to the support levels of $1775 and $1760. If this happens, it will be a new opportunity for a return to buying. Gold will be affected today by the strength of the US dollar and the reaction to the announcement of a package of economic data at the end of trading this week.