In its best daily performance in more than a month, the price of gold moved to the resistance level of $1868, a 5-month high, before settling around $1852 as of this writing. Gold's strong gains came after data showed a sharp acceleration in US consumer price inflation in October. The dollar also strengthened against the other major currencies as rising inflation raised concerns about the US interest rate outlook. Accordingly, the US Dollar Index rose to 94.84, gaining nearly 1%.

In the same performance, silver futures rose to settle at $24.772 an ounce, while copper futures contracts for December settled at $4.3230 an pound.

Data from the Labor Department showed that the US Consumer Price Index jumped 0.9% in October after rising 0.4% in September. Economists had expected consumer prices to rise 0.6%. Excluding higher food and energy prices, core consumer prices still rose 0.6% in October after rising 0.2% in September. Core prices were expected to rise 0.4%.

The Labor Department also said that the annual rate of growth in consumer prices accelerated to 6.2% in October from 5.4% in September, reaching the highest level since November 1990. The annual rate of growth in core prices also accelerated to 4.6% from 4%, reflecting the largest jump In prices since August of 1991.

The accelerating rate of consumer price inflation has raised concerns about the interest rate outlook even though the Fed has indicated it will not be in a hurry to start raising rates.

On the US labor market, a separate report from the Labor Department showed that initial US jobless claims fell to 267,000 in the week ending November 6, a decrease of 4,000 from the previous week's revised level of 271,000. Economists had expected jobless claims to fall to 265,000 from 269,000 that were reported the previous week. Claims for unemployment benefits fell for the sixth consecutive week, falling again to their lowest level since reaching 256 thousand in the week ending March 14, 2020.

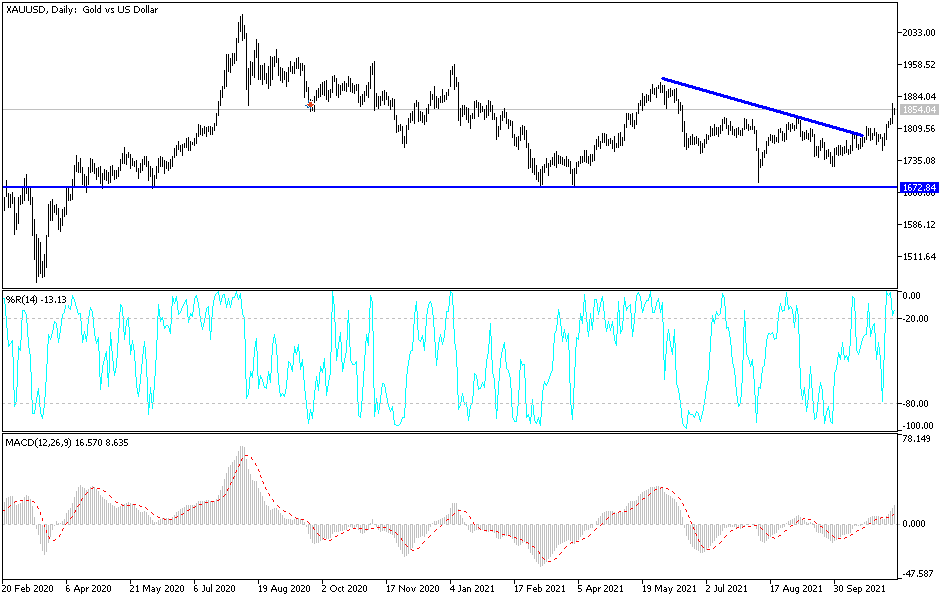

Gold Technical Analysis

All the bullish levels that we expected for the price of gold since it crossed the psychological resistance of $1800 have been reached. The question now is when will the gains stop? This depends on the strength of the US dollar and the extent of risk appetite. In general, we do not rule out the next psychological resistance of $1900 in the event that the bulls move towards the resistance levels of $1873 and $1885, taking into consideration that the recent gains pushed some technical indicators to overbought levels.

On the downside, it is necessary to break below the $1800 level to have an opportunity to change the general bullish trend. Today there is an American holiday, but the results of inflation and the US labor market will have a reaction on investor sentiment and therefore the price of gold.