The weakness of the US dollar strongly contributed to the increase in the price of gold, reaching the resistance level of $1827 as of this writing. This is the metal's highest in two months, where it is stable as of this writing, ahead of the announcement of US inflation figures and new statements by global central bank officials. The yellow metal is looking to maintain its rally since the end of the Fed's monthly policy meeting. Gold is retreating from a weekly gain of 1.4%, reducing its loss since the start of the year to date to 4.25%. As for the price of silver, the sister commodity to gold, it is trying to break through $24.50. The price of the white metal enjoyed a 0.9% rise last week, but it is still down more than 8% this year.

Overall, the metals market found surprising support after the US central bank announced that it would cut monthly bond holdings by $15 billion per month and indicated that it could raise interest rates at a faster pace if that was "justified", whether based on economic expectations or an increase in interest rates.

In this regard, Marius Hadjikiriakos, chief investment analyst at XM.com, wrote in a daily note: “The decline in yields has once again revived gold prices, which hit a two-month high on Friday.” On how quickly the Fed will pull the trigger on rate hikes, benefit each time expectations of normalization are pushed back and suffer each time they are presented.”

However, the Treasury market reversed its losses at the beginning of the week's trading. The benchmark 10-year bond yield jumped to 1.484%. One-year yields rose to 0.147%, while 30-year yields rose to 1.903%. Higher yields are downside for gold because it raises the opportunity cost of holding non-yielding bullion.

This week, all eyes will be on US inflation. The Producer Price Index will be released on Tuesday and is expected to come in slightly higher at 8.7%. The Consumer Price Index (CPI) is expected to rise to 5.8%. Gold is usually seen as a hedge against inflation, although its historical performance has been mixed.

The US currency declined with the beginning of this week's trading, as the US Dollar Index (DXY), which measures the dollar's performance against a basket of six major competing currencies, fell to 94.21. A lower exchange rate is a good thing for dollar-denominated goods because it makes them cheaper to buy for foreign investors. Since the beginning of the year 2021 to date, the DXY Dollar Index is up by about 5%.

In other metals markets, copper futures rose to $4,362 a pound. Platinum futures rose to $1051.30 an ounce. Palladium futures rose to $2,031.50 an ounce.

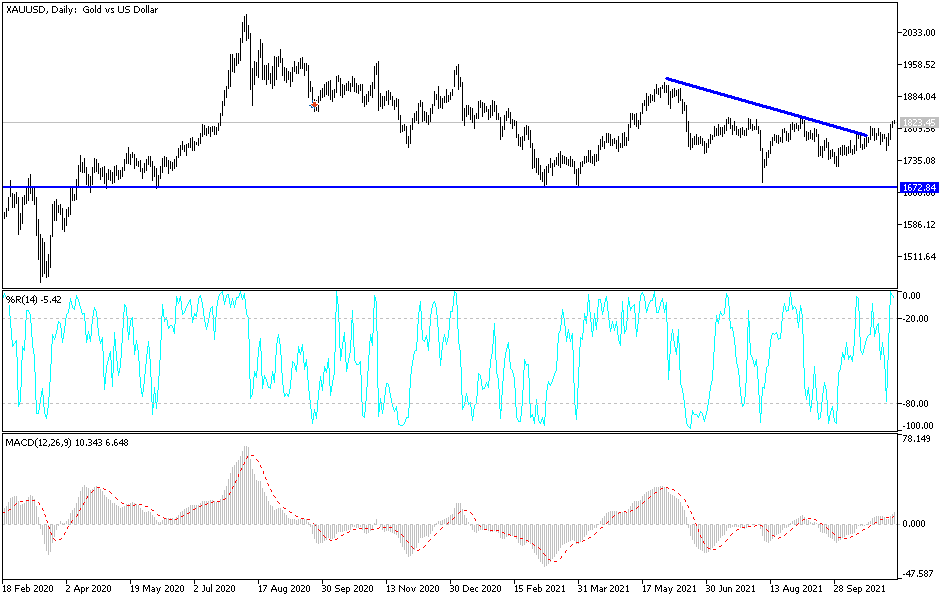

Technical Analysis

The stability of the gold price will remain above the psychological resistance of $1800, a catalyst for the upward trend. The price has already reached the target levels I have previously mentioned, including $1819 and $1827, with the $1845 level remaining. Gold is traditionally safe for investors in times of uncertainty. On the other hand, the gold price will not abandon the current trend without returning below the $1800 level again.