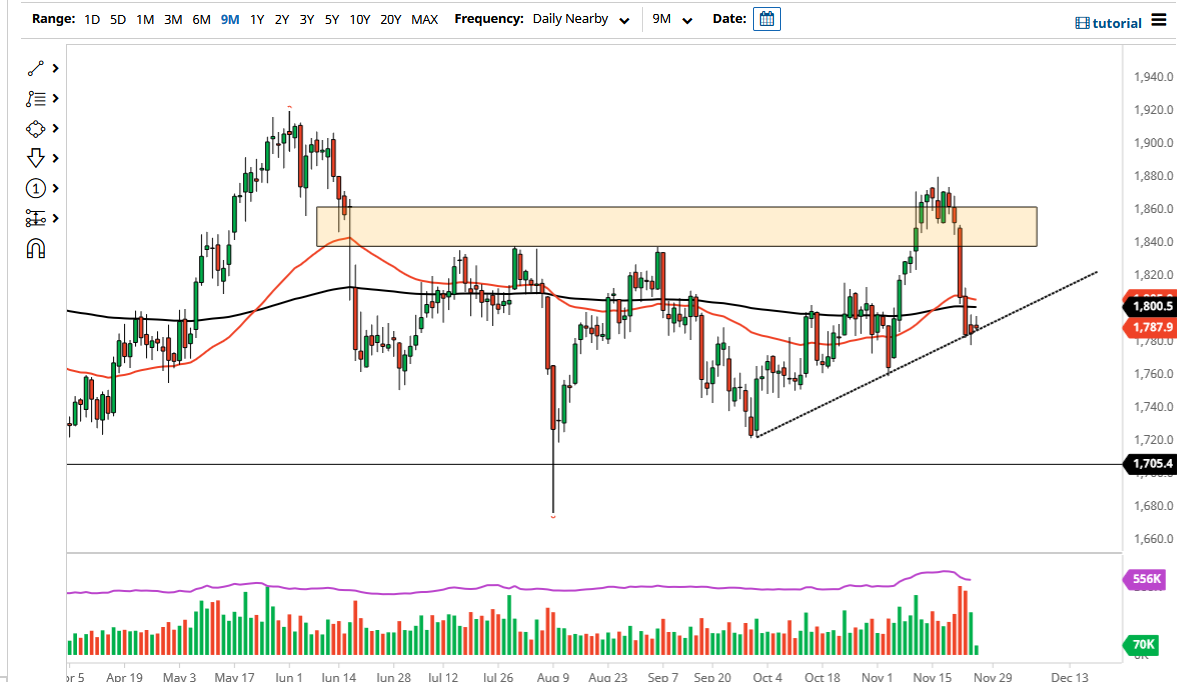

Gold markets were very quiet during the trading session on Thursday, as one would expect due to the Thanksgiving holiday in America. Quite frankly, there was not enough liquidity out there to get this thing moving, so now we are just sitting at the uptrend line that had been so important previously. Because of this, the market is probably going to continue seeing plenty of negative pressure, but we are a bit oversold.

Remember, the Friday trading session will be somewhat limited, due to liquidity restraints and of course the fact that most Americans do not come back to work during the Friday session after Thanksgiving. There will be shortened hours, and therefore I do not read too much into the Friday session currently. However, one thing to pay attention to is that we are sitting on top of a major trendline and have recently been sold off so drastically that a bounce would almost be expected. That bounce more than likely for me will be a signal that I should start looking for a selling opportunity. In fact, it is not until we break above the $1820 level that I would consider being a buyer of gold.

Pay attention to the US Dollar Index because it does have a strong negative correlation to the gold market, and it should be noted that the US dollar has been extraordinarily strong over the last several sessions. As long as that is going to be the case, then I think gold has major issues. Further exacerbating this issue will be whether or not interest rates in America continue to rise, mainly front running the Federal Reserve and any bond buying purchase tapering that they do. Jerome Powell has been quite implicit in the idea of cutting back on purchases, and this of course will make the rates in America much more attractive.

If we break down below the lows of the Wednesday candlestick, it is very likely that we will continue to fall, perhaps reaching towards the $1760 level. After that, then we are more than likely looking at an attempt to get down to the $1725 level. When you see the type of destruction that we have seen over the last couple of days, it is pretty rare that it happens in a vacuum, and that it is a one-time event.