The US dollar recovered after the re-appointment of Jerome Powell as chairman of the Federal Reserve, pushing the GBP/USD towards the 1.3342 support level before settling around the 1.3380 level as of this writing. Expectations of that the BoE will tighten its monetary policy soon still give the pound some momentum.

Overall, the highly anticipated BoE decision to start raising interest rates will be emblematic of success in guiding the British economy through the latest crisis, one of the Bank of England's nine rate-setting experts said this week as market speculation continues over a rate hike in December.

Analysts and investors have grown enthusiastic this week in anticipation of the Bank of England's decision in December to raise the bank interest rate from 0.1% to 0.25%, a move many expect to be a precursor to further increases over the course of 2022. This comes after inflation accelerated to more than double the target of The Bank of England in October, continuing the upward trend that has already prompted the Bank to warn repeatedly in recent months that it will likely be necessary to raise borrowing costs somewhat over the coming years.

In this regard, Jonathan Haskell, one of the six members of the Monetary Policy Committee at the Bank of England, said in a speech: “In my view, the expected rise in the bank rate from the emergency level - when it happens - is not a mistake, but an advantage: it reflects the success of Fiscal and health policy and science in dealing with the worst economic shock in 100 years.”

UK inflation rose to 4.2% in October from 3.1% previously while many economists and the Bank of England itself warned that annual price growth could exceed 5% at times over the coming quarters due to factors widely said to be temporary. Much of the variation in inflation rates is due to global factors such as imported goods and energy prices. I expect much of that difference to be temporary, Haskell told his audience at an event hosted by the University of Glasgow's Adam Smith School of Business. "The message of this graph is that future hikes in the bank interest rate are very much indicative of a recovery," Haskell added.

Also significant to the bank's rate outlook is that a flurry of recent data suggests the UK economy has regained some of the momentum it lost earlier early in the last quarter, the latest being the IHS Markit PMI surveys for the manufacturing and services sectors on Tuesday.

So says Bethany Beckett, UK economist at Capital Economics: “November's flash PMIs suggest that the economy has proven somewhat resilient even as it brings more signs of continued rising price pressures. This indicates to us that the balance of probability at the Bank of England's monetary policy meeting in December remains skewed in favor of a rate hike, likely from 0.10% to 0.25%.”

Technical Analysis

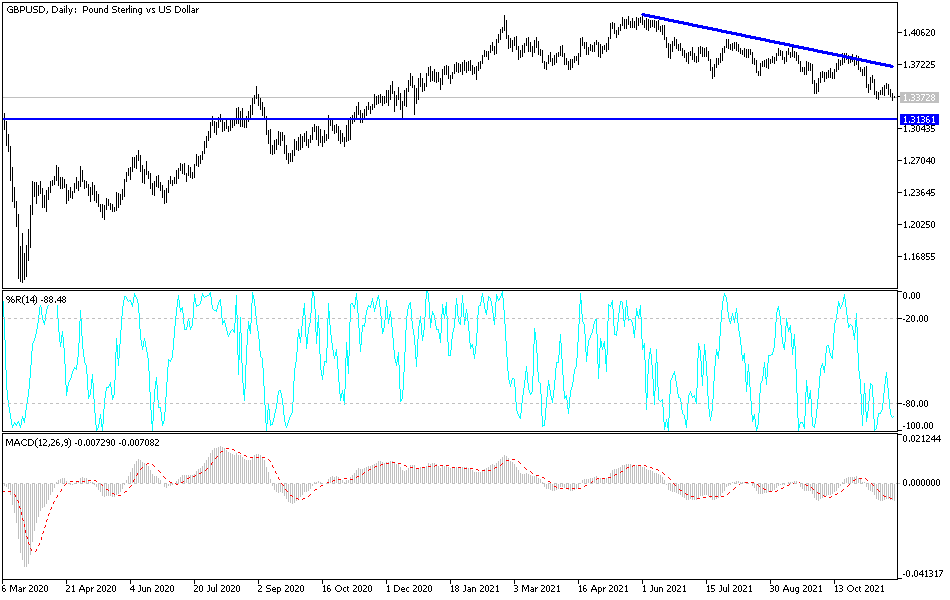

On the daily chart, the general trend of the GBP/USD currency pair is still under bearish pressure, which may increase if the pair moves below the 1.3300 support level. Sell-offs may occur and technical indicators may reach oversold levels if it moves towards the support levels at 1.3220 and 1.3155. On the upside, breaking through the 1.3520 resistance will stimulate the bulls again and maintain the bullish outlook.

All focus will be on the US economic data, including the announcement of the GDP growth rate, durable goods orders, the number of weekly jobless claims, the personal consumption expenditures price index, the Fed’s preferred measure for measuring US inflation, and the minutes of the last meeting of the US Federal Reserve.