Investors bought the British pound again, and the GBP/USD moved towards the 1.3607 resistance level yesterday before settling around 1.3550 as of this writing. Sterling's move in the Forex market came as rapid re-quotes of future interest rate hikes in the Bank of England are nearing completion and current exchange rates are more in line with expectations of a rate hike in February.

"Positions still favor bullish strategies over sterling," says Roberto Mialic, Forex analyst at UniCredit in Milan.

The British pound is the biggest loser among the world's largest currencies when examined over the past month, thanks to the bank's surprisingly peaceful turn last Thursday, but a look at the currency's performance on November 8 suggests that there are those who are willing to pull back and return to the market. With the sterling hike looming last Thursday, analysts of the Bank of England's policy decision warned that policy makers would veer away from the sterling's rally.

But few analysts and Forex strategists were prepared for how pessimistic the bank is about the prospects for future hikes. So Robert Wood, UK economist at Bank of America says: “What really surprised us from the Bank of England last week is the strength of their cautious tone. And it wasn't just that they didn't scale up, they were also pessimistic about future hikes." The analyst also added: “The BoE Mood Index, based on the natural language processing of the BoE minutes that we update here, supports our subjective impression. It has fallen to its lowest level since May."

If the pound stabilizes from here, it could indicate that the market has rebalanced itself away from the 2021 rally to the February 2022 move, which money markets now consider a 100% possibility. The odds of a December rate hike have fallen below 50%.

For the FX markets, the bottom line is that the bank will likely still raise interest rates ahead of a number of other G10 central banks, notably the European Central Bank and the US Federal Reserve, allowing for some price support against the euro and dollar.

Juan Prada, currency analyst at Barclays, says he expects sterling to get a better boost from now on. He stated, “Sterling fell after the Bank of England defied market expectations to raise interest rates by 15 basis points. The 7-2 decision to keep interest rates unchanged has shaken global markets, even spreading to many emerging markets where interest rate payments are taking a breather.”

Economists at Barclays say the bank's "pessimistic turn" appears to have been the result of a calmer economic growth outlook. The bank has lowered its 2021 economic growth forecast to 6.7% from the 8.5% forecast in August. However, the GDP forecast for 2022 increased from 2.3% to 2.9% while the forecast for 2023 was lowered to 1.1% from 1.3% previously. However, inflation is expected to remain well above the 2.0% target over the coming months and the Bank has indicated its willingness to act by raising interest rates as a result.

BoE Chief Economist Hugh Bell told business leaders on Friday, November 5th that he expects wage inflation in the UK to outpace that of the US and the Eurozone.

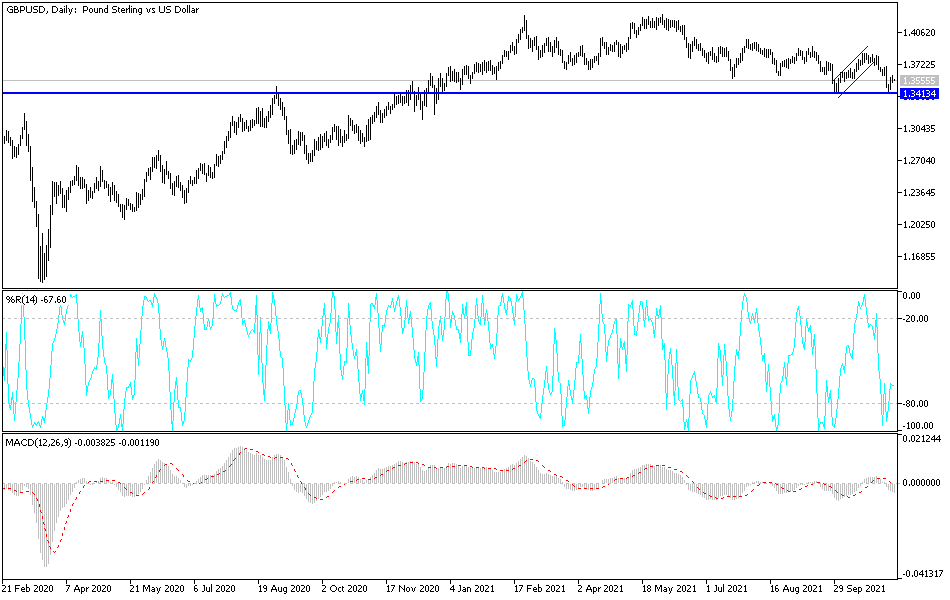

Technical Analysis

On the daily chart, the GBP/USD is in a stable neutral position with a bearish bias, and approaching the 1.3500 support will open for lower moves to the next targets ta 1.3450, 1.3370 and 1.3300. These are areas that confirm the strength of the bearish trend. To the upside, the bulls should move towards the resistance levels at 1.3690 and 1.3820 to confirm a bullish trend change.

The currency pair will be affected by the release of US inflation figures and the number of weekly jobless claims.