For three trading sessions in a row, the GBP/USD has been sold off, settling around the 1.3605 support level, the lowest in more than two weeks. The US dollar is still supported in the Forex market, with the US Federal Reserve starting to tighten its monetary policy amid the US economy recovering from the effects of the epidemic, which pave the way for raising interest rates.

The danger for Fed Chairman Powell is that COVID-19 has brought more lasting changes to the labor market than apparently thought, making it difficult to return to pre-pandemic levels without stimulating inflation. In the event of an asymmetric shock like COVID-19 that is likely to have lasting effects, the Fed should pursue expansionary monetary policy to generate “a small amount of additional inflation.” This will help facilitate the transformation of the economy and the movement of workers from one sector to another.

In return, British Chancellor of the Exchequer Rishi Sunak gave a personal guarantee that, in the absence of a crisis, debt as a share of the British economy would shrink from 2024 onwards. In his budget last week, Britain's chancellor set a rolling three-year target for reducing the burden of ballooning debt. But he has faced criticism that the base will never work as it moves forward every year.

He stated, "Although it is a renewed forecast, my opinion is that the right thing for the public finances and economy of the country is to proceed on the path we have set, and not to continue pushing it into the future. In the absence of it shouldn't be a case of taking advantage of a tiered rule because there is basically no rule. And it wouldn't be true, I don't think that would be responsible. It would undermine the whole point of fiscal policy.”

Official forecasts released along with the budget show that debt rose as a percentage of GDP in the first two years and only declined slightly in the third. Sunak admitted that, all else being equal, a 1 percentage point increase in interest rates would mean the target was not met. For its part, the Office of Budget Responsibility, the government financial watchdog, said, “History tells us that advisors tend to benefit from the additional year by loosening fiscal policy now while planning a major fiscal tightening for the target year.”

“What kind of assurance can you give us that this time will be different?” asked Mervyn King, a former Bank of England governor who serves on the Committee of Lords.

Sunak also said he was confident of a strong recovery in the labor market, after the vacation program expired on October 1. "In general, what I see, and when I talk to companies in the informal work we do, would lead one to cautiously optimistic that the result of employment after the end of the leave will not be anywhere near as bad as people fear," he stated. The state of the labor market is a major factor for the Bank of England as it faces rising inflation. The British central bank will announce its interest rate decision on Thursday, with markets anticipating an increase in the interest rate from 0.1% to 0.25%.

Technical Analysis

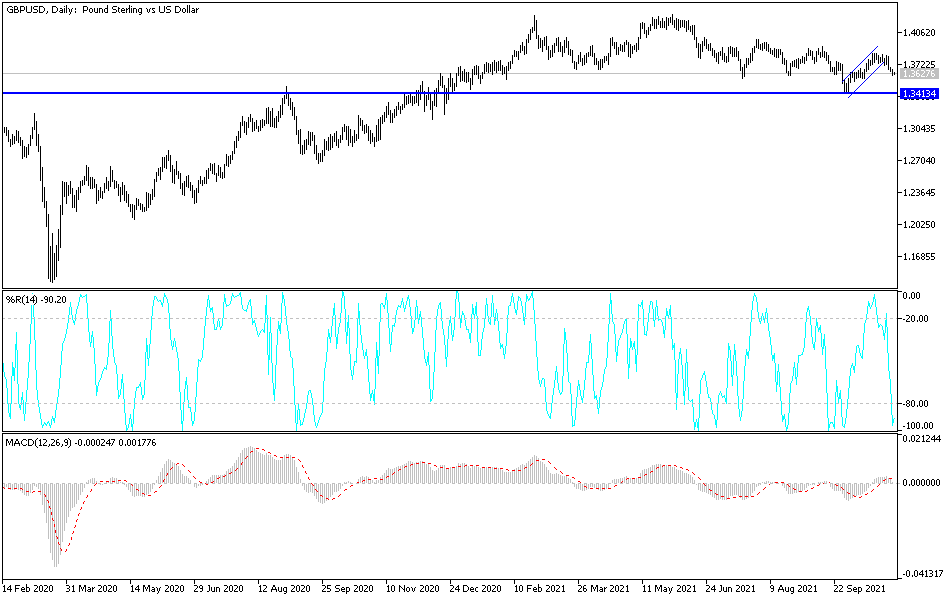

On the daily chart, there was a clear break of the bullish channel for the GBP/USD, and the continuation of the dollar’s strength will not prevent the bears from moving towards the support levels at 1.3560 and 1.3440. These are good buying levels because they will push the technical indicators towards oversold levels. On the upside, the 1.4000 psychological resistance will remain vital for bulls to continue to dominate the general trend. Today, the UK Services PMI will be announced.

From the United States, the ADP reading will be announced to measure the change in US non-agricultural employment, then the ISM purchasing managers' index for services, ending with the important monetary policy decisions of the US Federal Reserve and the statements of Chairman Jerome Powell.