Although Britain did not announce COVID restrictions like the rest of the European countries the pound was affected by concern about new lockdowns in Europe. Accordingly, the GBP/USD was sold off towards the 1.3385 support level, and investors returned to buying the US dollar as a safe haven.

The GBP/USD attempted to stabilize above a new low for November and is likely to correct higher in the coming days if uncertainty over the White House's decision on Fed leadership leads to a temporary pullback in the US currency. The British pound was the top performing currency for the five days by Monday and was one of only two major currencies to gain against the dollar last week after British economic data spurred confidence in parts of the market that are betting the Bank of England may raise interest rates in December. .

The US dollar gained strong momentum in the Forex market with the announcement of US President Joe Biden extending Jerome Powell's term as head of the US Federal Reserve for another 4 years. Biden also said he would nominate Lyle Brainard for vice president, the only Democrat on the Federal Reserve's board of governors and the preferred alternative to Powell among many progressives.

Financial markets have recently begun to bet confidently that the US Federal Reserve is likely to raise interest rates as soon as June or July next year, with the swap rate indexed on Monday indicating that it will raise the Fed funds rate twice before the end of the year. 2022. Dollar weakness could be supportive of GBP/USD although there is also a risk that the greenback will be lifted on Wednesday and sterling weighed down by the next batch of PCE inflation figures and the November Fed meeting minutes.

Wednesday's core PCE price index is the Fed's preferred measure of US inflation and will likely be closely scrutinized by the market at 15:00 midweek, with the data released just hours before the minutes of this month's Fed meeting are released. North American traders will be out for the Thanksgiving holiday from Thursday, when sterling is likely to take cues from Bank of England Governor Andrew Bailey and chief economist Howe Bell who are due to address the masses on Thursday and Friday, respectively.

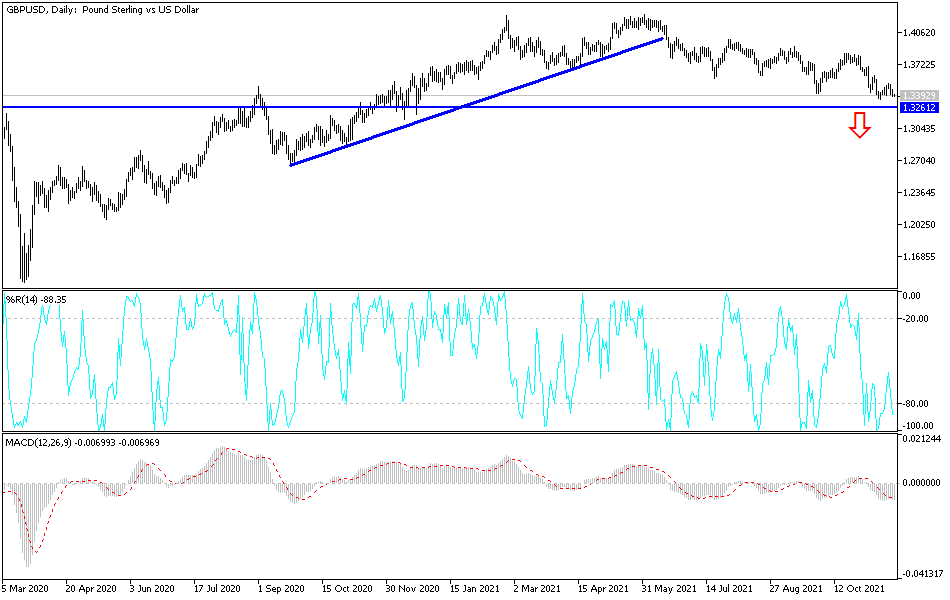

Technical Analysis

On the daily chart, the GBP/USD is subjected to sell-offs, and the bears’ control will increase for a while if they move the currency pair below the 1.3350 support level, which may then move to the 1.3190 support unless the pound gets new momentum. On the upside, the 1.3600 resistance must be breached for bulls to have a shot at control.

The currency pair will be affected today by the announcement of the PMI readings for the manufacturing and services sectors for both Britain and the United States. This is in addition to the reaction to the renewal of Jerome Powell's term, COVID cases, and risk appetite.