Britain is expanding its COVID-19 booster vaccine program to millions more people as part of efforts to tackle the spread of the new omicron variant, which is feared to be more contagious and resistant to vaccines. In light of this concern, the GBP/USD currency pair is subjected to downward pressures, stable below the 1.3300 support level, which motivates the bears to gain more control. The pair’s recent losses brought it to the support level at 1.3278, its lowest of the year.

Yesterday, the British government said it would fully accept revised recommendations from the independent body of scientists that was advising it, the most important of which was that everyone between the ages of 18 and 39 should get a booster dose. So far, only people over the age of 40 plus those considered particularly vulnerable to contracting the virus were eligible. The change in advice means about 13 million people will be eligible for the vaccine. To date, the UK has provided around 17.5 million booster doses.

The spread of the omicron variant, which contains far more mutations than previous strains, has raised fears that the coronavirus pandemic will find new legs over the coming months. It will take scientists a few weeks to gain a greater understanding of how the new variant is spreading. Already, the British government has tightened the rules for the wearing of masks and the testing of arrivals into the country. British Prime Minister Boris Johnson said on Saturday it was necessary to take "meaningful and precautionary measures" in England.

The GBP/USD price showed signs of stabilizing near new 2021 lows last week and may attempt a corrective recovery if global markets recover from recent losses this week, although another “optimistic” turn is possible at the US Federal Reserve. To limit the possibility of a recovery of the pound sterling. The pound may have suffered heavy losses against the lower-yielding funding currencies last Friday, but proved relatively resilient against the dollar when the limited declines were pared ahead of the weekend, which could leave the GBP/USD rate vulnerable to a rebound early this the week.

“The market is losing bearish momentum in the very near term, yet it remains under pressure,” says Karen Jones, Head of Technical Analysis for Currency, Commodities and Bonds at Commerzbank. “After a slight bounce, the pair is likely to remain under pressure and on course for the 200-week moving average at 1.3158,” Jones and colleagues wrote in a research presentation on Friday.

However, the goal for sterling is that any such recovery may eventually be limited in duration and size due to the heightened risk of an additional "tough" shift in the Fed's monetary policy stance, a risk that has already weighed heavily on sterling since last week.

Technical Analysis

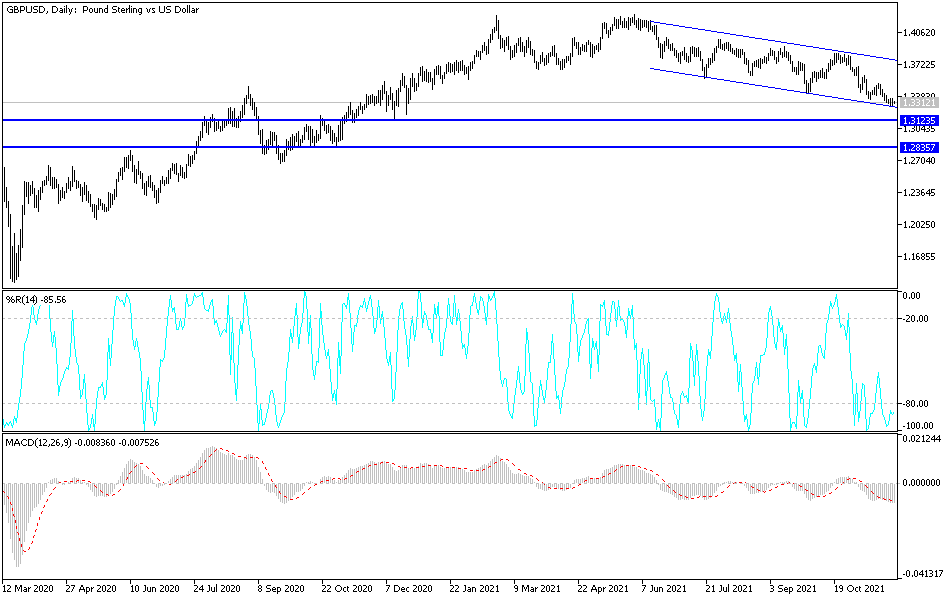

The general trend of the GBP/USD pair turned bearish, and moving below the 1.3300 support will stimulate the bears to launch further. The next stronger support levels will be 1.3220 and 1.3140, then the psychological support 1.3000. To give the bulls control, the currency pair must return towards the 1.3660 resistance, according to the performance on the daily chart. In general, the GBP/USD pair will react strongly to risk appetite, in addition to the world's restrictions to contain COVID.

Today's economic calendar is devoid of any important British economic data, and the focus will be on the announcement of the US consumer confidence reading and the testimony of Federal Reserve Chairman Jerome Powell.