The British pound suffered heavy losses against low-yielding and safe-haven currencies before the weekend after a new strain of the virus led to panic in global financial markets, which could have various repercussions for the GBP, the EUR and the USD. In the case of the GBP/USD pair, it fell to the 1.3278 support level, its lowest of the year. It closed trading stable around the 1.3327 level, and its highest gains on Friday reached the 1.3365 resistance.

The British pound incurred its biggest losses against the Swiss franc, the traditional safe haven for investors during times of uncertainty, but it was also in the red against the Japanese yen and the euro while it witnessed more modest declines against the US dollar as investors responded to the discovery of a new strain of the Corona virus in Africa.

The euro, yen and Swiss franc were sold heavily throughout the year by investors and traders who used the proceeds of these sales to fund bets on more attractive and yielding currencies such as the British pound and the dollar and commodity currencies such as the Canadian dollar and the Australian dollar. Obviously, these were some of the first situations that were pared back on Friday as the first details of the new virus strain first detected in South Africa reached investors and traders.

The response of global financial markets on Friday was great, with stock markets falling sharply across the world, while some commodities such as oil fell by a factor of double in what could turn out to be an overreaction. But other than that, the new virus strain contains a number of mutations compared to the other variants, very little is known about them so far. Some market watchers have expressed concerns that it may be more transmissible or resistant to available vaccines, with the idea that it could give some governments reason to try to reimpose restrictions on business and social contact.

This was one of the reasons why the downside risk from the GBP/EUR exchange rate is so limited and less than the risk of further losses for the GBP/USD. Commenting on this, Neil Schering, chief economist at Capital Economics, says: “The lesson of the past two years is that it is restrictions imposed in response to the virus – not the virus itself – that is causing the bulk of the economic damage. So, the key question is how governments will respond if the B.1.1.529 strain spreads.”

Various approaches to managing the virus are emerging. In the United Kingdom and the United States, governments have shifted a little more towards a "learning to live with the virus" approach. This means that the barrier to severe restrictions on activity is probably higher than in Europe, where governments are already adopting new measures in response to the sharp rise in the delta variable. So far, there are no virus restrictions in place in Britain, which has one of the highest vaccination rates there, although some governments in Europe had already resorted to re-imposing "lockdowns" and other strict new restrictions even before the new strain was discovered. .

Countries such as Slovakia, Portugal, Austria and the Netherlands had already shut down their economies before Friday and there were concerns that others would soon follow suit, and the discovery of the new strain is unlikely to reduce that risk.

Jordan Rochester, an analyst at Nomura, said: “We doubt Britain will enter lockdowns again, but we were arguing that the pound wasn't already weaker given the movement in real yield margins over the 5-year period before the alternative was discovered. Accordingly, we prefer to sell GBP/USD as a better expression of the GBP view.”

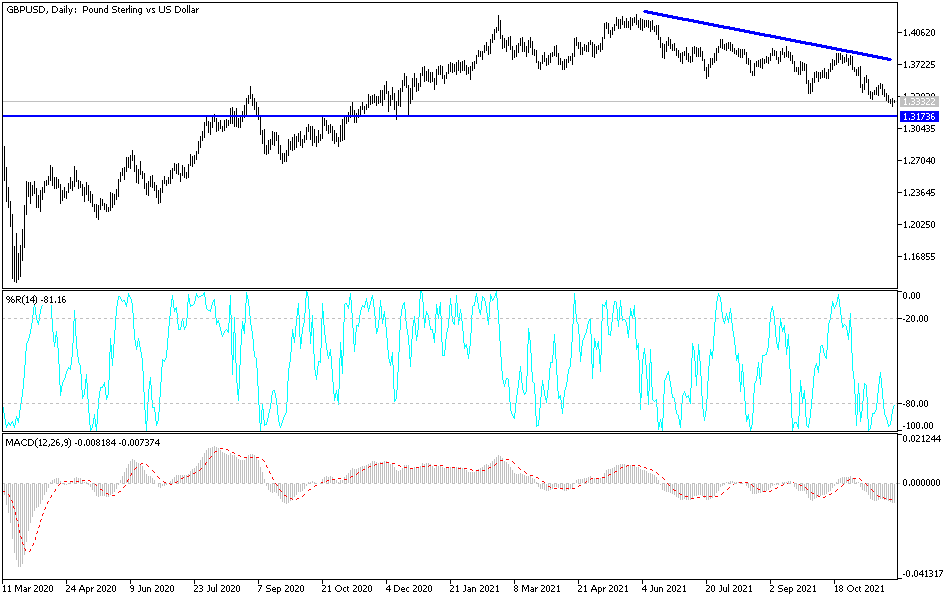

Technical Analysis

There is no change in my technical view of the GBP/USD pair, as the general trend has turned bearish. Moving below the 1.3300 support will open up for moves lower to the next support levels at 1.3220 and 1.3140, then the psychological support at 1.3000. For the bulls to have any hope, the currency pair must return towards the 1.3660 resistance, according to the performance on the daily chart. The GBP/USD pair will react strongly to risk appetite, as well as the world's restrictions to contain COVID.

Today, Britain will announce the money supply, net lending to individuals and mortgage approvals. From the United States, pending home sales and new statements from US Federal Reserve Governor Jerome Powell will be released.