Bearish View

Sell the GBP/USD and set a take-profit at 1.3600.

Add a stop-loss at 1.3750.

Timeline: 1-2 days.

Bullish View

Set a buy-stop at 1.3700 and a take-profit at 1.3800.

Add a stop-loss at 1.3600.

The GBP/USD made a major bearish breakout on Friday after the US published strong inflation and consumer spending data. The pair declined to a two-week low of 1.3667, which was about 1.12% below the highest level in October.

Bank of England Decision

The GBP/USD declined sharply on Friday as the US dollar made a major bullish comeback. This happened after data by the American government showed that the country’s personal consumer expenditure remained at the highest level in more than 30 years.

At the same time, consumers were unfazed by the rising prices as they continued to spend. As a result, investors believe that the Federal Reserve will start tapering its asset purchases and sound relatively hawkish when it delivers its interest rate decision later this week.

The pair was in a tight range in early trading as investors reacted to the latest China manufacturing data. According to the National Bureau of Statistics, the country’s Manufacturing PMI moved below 50 for the second straight month. Companies complained of the rising power costs, higher input prices and ongoing logistics challenges.

Later today, Markit will publish the latest PMI data from the UK and the US. These numbers are expected to show that the sector remained steady in the two countries. Its impact on the US dollar and sterling will be relatively minimal.

Later this week, the key mover for the GBP/USD pair will be the Federal Reserve and Bank of England (BOE) interest rate decisions. The two banks are expected to hold fire on interest rates during this meeting.

However, they will likely signal that interest rates will start rising earlier than expected. Also, the banks are expected to start tapering asset prices considering that their inflation rates are rising.

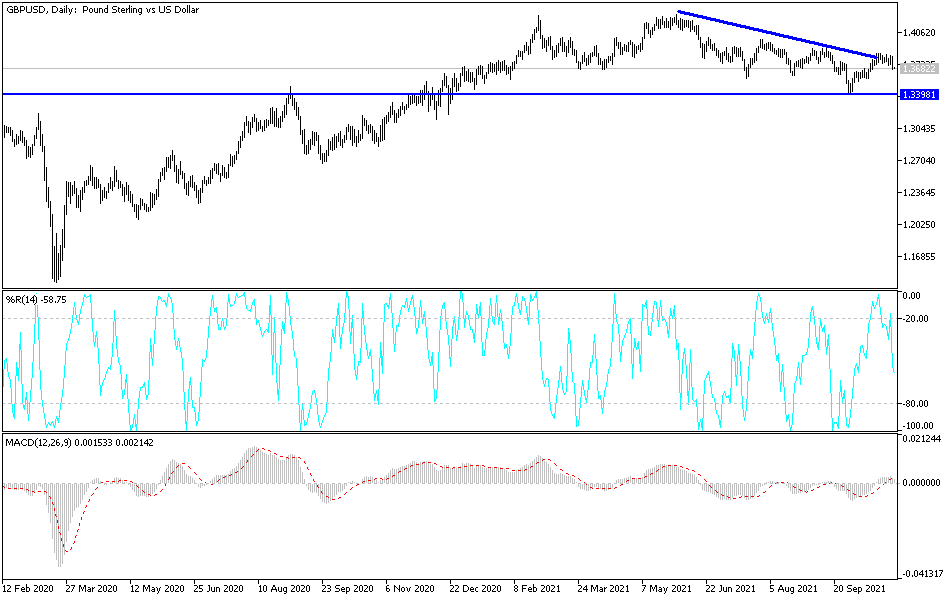

GBP/USD Forecast

The four-hour chart shows that the GBP/USD pair made a bearish breakout on Friday. The pair moved below the lower side of the falling widening channel shown in black. It also declined below the lower side of the ascending channel shown in red and the 25-day and 50-day moving averages. The Relative Strength Index (RSI) has also been in a bearish trend.

Therefore, the pair will likely continue falling as bears target the next key support level at 1.3600. On the flip side, a move above the key resistance level at 1.3760 will invalidate the bearish view.