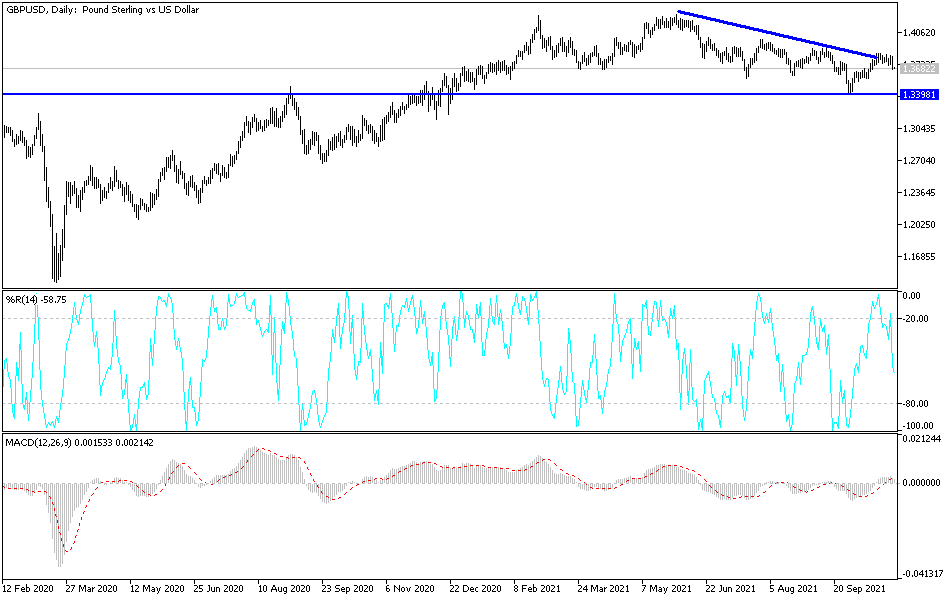

The British pound fell rather hard on Friday to break through the 1.37 handle. The 1.37 level is a large, round, psychologically significant figure and a lot of people will pay close attention to that area. The 1.38 level above is a significant resistance barrier, but if we can break above there, then the market is likely to go much higher. Ultimately, this is a market that is looking towards the 1.40 handle.

On the other hand, if we break down below the bottom of the candlestick during the Friday session, then it is likely we will go looking towards the 1.36 handle. After that, then we could go looking towards the 1.35 handle. A breakdown below that level could open up a massive selloff in this pair and show that the British pound is about to pull apart. The Bank of England is likely to raise interest rates between now and the end of the year so it will be interesting to see how this plays out, but in theory it should be a good thing. However, we have seen such a massive turnaround in the greenback during the day on Friday, it is probably going to continue to be a very difficult trade going forward.

European currencies have been where we have seen a lot of selling pressure against the greenback, as commodity currencies have held up a bit better. Ultimately, the general attitude of this market has been “buy on the dips”, but it is worth noting that we have seen the market really pick up towards the end of the day to the downside, so that does suggest that perhaps we could have a little bit of ugliness ahead. That being said, you can also take a look at this chart through the prism of simple Brownian motion, suggesting that we just do not have anywhere to be right now. At this point, it looks like Monday needs to be a positive candlestick, or we may see a little bit of a selloff. I think you will continue to hear a lot of noise, and that is probably how you have to play this market. Cautious position sizing is crucial, so I would not get too big of a position at this point. One thing we need is stability.