European COVID restrictions continue to hurt the euro, and accordingly, the bearish pressure for the EUR/USD continued. The pair fell to the 1.1226 support level in early trading today, its lowest in more than 16 months. The euro may remain under this pressure long term because the restrictions impede the economic recovery of the bloc at a time when the United States of America is enjoying a recovery from the effects of the epidemic, which brings the US Federal Reserve the opportunity to raise US interest rates.

The EUR/USD pair may face a collapse to the cusp of the 1.10 psychological support if the dollar remains in place while European economies continue to rush towards another winter of 'close'.

The single European currency, the euro, had suffered its biggest losses since early June and the days immediately following the start of the Fed's preparations for the markets for a steady withdrawal of monetary stimulus offered to the US economy since the start of the coronavirus crisis. The euro traded against the dollar as low as 1.1249 last week as the dollar advanced against all major currencies except the British pound and the renminbi, while the single European currency fell against all but the most risk-sensitive regional currencies.

Commenting on the performance, Juan Manuel Herrera, strategist at Scotiabank said, “The combination of a very pessimistic ECB and now the possibility that economic activity will be suppressed due to restrictions poses clear downside risks for the euro towards levels of 1.10/11. We therefore continue to monitor developments on the energy front as Delays in approval of Nord Stream 2 are likely to drive up energy costs on the continent, and act as an additional headwind.”

The euro's losses against the dollar came after both Austria and the Netherlands announced plans to return their countries and economies to a form of "lockdown" in political decisions amid suggestions from German officials that they could also begin to re-impose restrictions in parts of the country during the coming period.

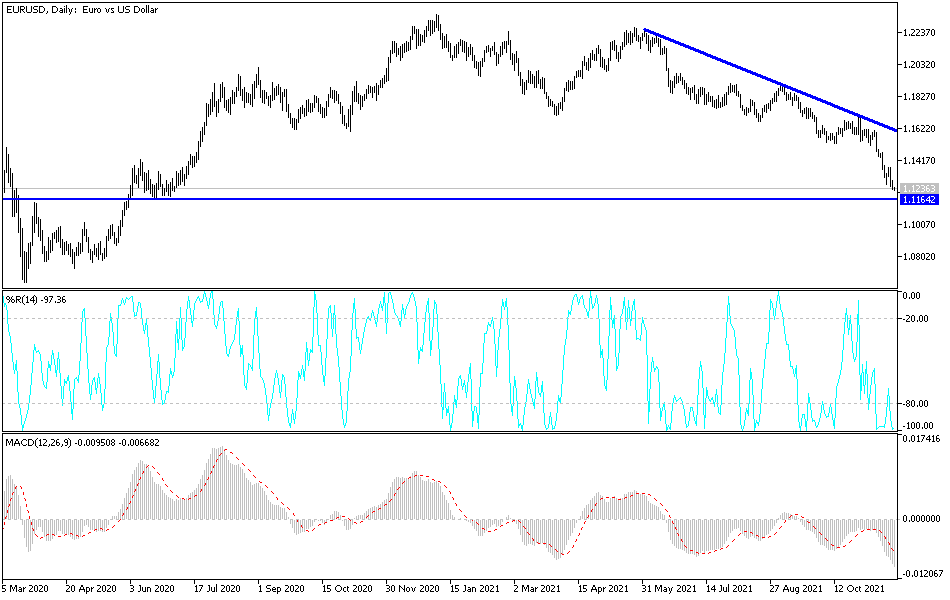

The specter of a new economic shutdown has dampened the outlook for recovery in the Eurozone and is likely to boost analysts and investors' expectations that the European Central Bank will lag its major peers such as the Federal Reserve and the Bank of England (BoE) when it comes to monetary policy normalization. The losses have broken the EUR/USD below the important technical support on the charts which consists of the 61.8% Fibonacci retracement of the 2020 recovery trend located at 1.1291, which is little below it other than the 1.1248 support to prevent the euro from sliding to 1.10.

Technical Analysis

The general trend of the EUR/USD pair is still bearish, and any attempt to rebound higher will be a target for selling, because it seems that the restrictions may last weeks and thus affect the economic recovery of the bloc, especially since the restrictions coincide with the annual holiday season, which has a strong effect on the European economy. Currently, the bears' closest targets are 1.1200, 1.1120 and 1.1000. The rebound attempts, I expect, will be temporary and very limited, and will not, in any case, exceed the 1.1475 resistance. I prefer to sell the EUR/USD pair from every bullish level.

Today, the euro will be affected by the announcement of the PMI readings for the manufacturing and services sectors for the Eurozone economies, and from the United States, the PMI readings for the manufacturing and services sectors will be announced.