The downward trajectory of the EUR/USD price is getting stronger due to long-term bearish pressure factors. The losses of the currency pair reached the 1.1433 support level, the lowest in 16 months, and closed last week's trading near it. The pressure factors are represented in the economic performance and the future of monetary policy in the Eurozone, which is suffering from new record waves of the pandemic. The European Central Bank is unlikely to tighten monetary policy soon, and the continent is suffering from the energy crisis and disruption of global supply chains.

The US, on the other hand, has witnessed an interesting recovery in all sectors of the American economy, and the pressure recently increased on the US Federal Reserve to accelerate the pace of tightening its policy and raise US interest rates.

To face the harsh waves of COVID in Europe, German Chancellor Angela Merkel said on Friday that people have a duty to vaccinate against the coronavirus to protect others. She spoke as Germany grapples with a new wave of infections that reached a daily record high of 50,000 on Thursday. Merkel spoke for 30 minutes with New Zealand Prime Minister Jacinda Ardern in a virtual wide-ranging discussion on the sidelines of the annual Asia Pacific Economic Cooperation Forum.

New Zealand hosts the APEC forum and, although Germany is not a member, Ardern said she is a long-time admirer of Merkel, who is leaving her post soon. "This virus is very, very tough," Merkel said. She added that it was a huge scientific achievement to produce vaccines within a year of the outbreak, but officials still did not reach a group of unvaccinated people. "You have the right to be vaccinated," Merkel said. "But, to some extent, you also, as a member of the community, have a duty to vaccinate to protect yourself and protect others."

About two-thirds of Germany's 83 million people have been fully vaccinated, but the nation has resisted making vaccinations mandatory for some workers. Lawmakers are considering new measures to counter the recent increase. During their discussion, both Merkel and Ardern expressed frustration over the spread of misinformation on social media. She stated, “In the old days, we had certain events that happened in our society. Television reported it and the next day everyone talked about it,” said Merkel. “Today, everyone is participating in their social media. You only participate in a bubble you meet on the Internet.”

Merkel also said that if there was any advice she could give future leaders, it would be to try to understand other people's perspectives and what motivates them to act the way they do. Ardern said one of the lessons she learned from the pandemic was to engage people and companies in trying to find solutions by providing them with data and showing them the problem. She said everyone was learning about the virus while it was spreading.

The APEC forum concluded with a virtual meeting of Pacific leaders, including US President Joe Biden and his Chinese counterpart Xi Jinping.

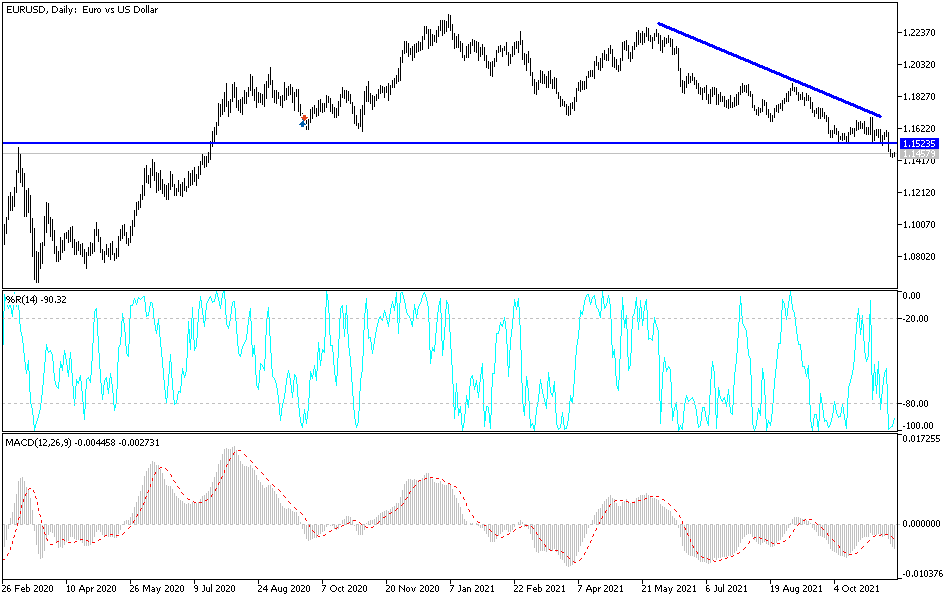

Technical Analysis

On the daily chart, the general trend of the EUR/USD is still bearish, and stability below the 1.1500 support keep the trend bearish for the longer term. The next bearish targets are 1.1410, 1.1365 and 1.1290. From the second and third levels, the technical indicators will move towards strong oversold levels. On the upside and over the same time period, the bulls will not disrupt the bearish performance without moving towards the 1.1690 and 1.1775 resistance levels.

Today, the trade balance figures for the Eurozone will be announced, followed by the Empire State reading of the US industry.