With the US dollar's gains stalled, the EUR/USD rebounded higher, but the gains did not exceed the 1.1608 level and the pair settled around 1.1582 as of this writing. As I mentioned before, the euro still lacks investor confidence due to the slowdown in the Eurozone economy due to supply chains and the energy crisis and the European Central Bank's loose policy. What happened to the ZEW Index yesterday did not support the euro much.

The survey results from ZEW - Leibniz Center for European Economic Research showed that German economic confidence improved for the first time in six months as financial market experts were more optimistic about the next six months. The ZEW economic sentiment index rose more than expected to 31.7 in November from 22.3 in October. This was the first time since May that the index recorded an improvement. The expected result was 20.

However, the assessment of the current economic situation deteriorated again, with the index falling to 12.5 from 21.6 in October. The result was also below economists' expectations of 18. Commenting on the results, ZEW President Achim Wambach said experts assume that supply bottlenecks for raw materials and intermediate products as well as high inflation will have a negative impact on economic development in the current quarter. Wambach added that in the first quarter of 2022, they expect growth to pick up again and inflation to decline in both Germany and the Eurozone. The Eurozone economic sentiment index improved for the first time since May. The corresponding index rose 4.9 points to 25.9 in November. On the other hand, the current situation index fell 4.3 points to 11.6.

Eurozone inflation expectations have fallen very sharply in the current survey.

The index came in at minus 14.3 points, which corresponds to a decrease of 31.4 points in the October survey. This indicates that experts expect the inflation rate in the Eurozone to decline over the next six months.

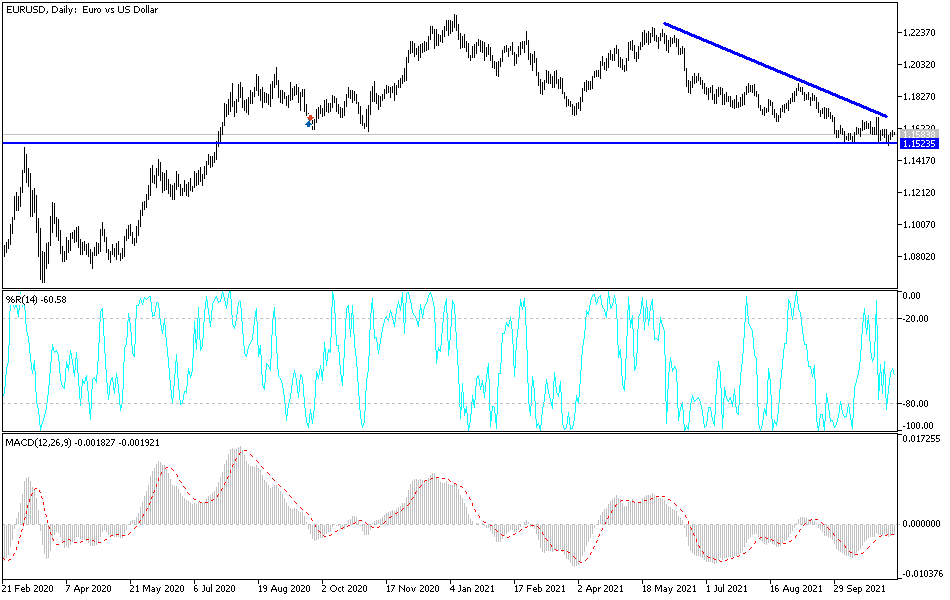

Technical Analysis

The EUR/USD pair's rebound attempts are still weak and the general trend is still bearish. Stability below the 1.1600 support would open for a move towards the next support levels at 1.1545, 1.1480 and 1.1390. To the upside, as I mentioned before, the resistance levels at 1.1750 and the psychological resistance at 1.2000 are crucial for a bullish trend change. The above-mentioned factors will remain continuous pressure factors on the performance of the EUR/USD in the coming period until any change occurs.

The German CPI reading will be announced, and then the US CPI readings and the US weekly jobless claims.