US inflation recorded a sharp jump that may force the US Federal Reserve to move faster than the markets expected, and the US dollar returned to steal more gains against the rest of the other major currencies. I mentioned previously that the economic performance and the future of the tightening central bank policies will remain pressure factors on the euro long term.

On the one hand, the US economy is constantly strengthening, which puts pressure on the US Federal Reserve to start tightening its policy and raise interest rates. On the other hand, the Eurozone is suffering from corona waves and disrupting supply chains, and the European Central Bank insists on maintaining its policy stance without the slightest indication of tightening its policy.

The US government announced yesterday that its Consumer Price Index is up 6.2 percent from a year ago - the largest annual jump since 1990. Commenting on this, Jason Furman, who served as the Obama administration's chief economic adviser, said: "It's a big blow to the passing narrative." Inflation is not slowing. She keeps a hot pace.” And while wages have risen sharply for many workers, they are not enough to keep up with prices. Last month, average hourly wages in the US, after accounting for inflation, fell 1.2% compared to October 2020. Economists at Wells Fargo joke that the Labor Department's Consumer Price Index - the Consumer Price Index - should stand for "consumer pain index." Unfortunately for consumers, especially lower-wage families, all of this coincides with higher spending needs just before the holiday season.

Price pressure is escalating pressure on the Fed to shift more quickly away from years of easy money policies. This poses a threat to President Joe Biden, Democrats in Congress, and their astronomical spending plans.

Due to the spread of COVID-19, the US economy collapsed in the spring of 2020 as lockdowns began, businesses closed or working hours were cut, and consumers stayed home as a health precaution. Employers cut 22 million jobs. Economic output fell at a record-breaking rate of 31% in the April-June quarter of last year. Companies cut investment. Restocking was postponed. A brutal recession ensued. However, rather than slipping into a prolonged recession, the economy began an unexpectedly dramatic recovery, buoyed by massive government spending and a series of emergency moves by the Federal Reserve. By spring, the rollout of vaccines encouraged consumers to return to restaurants, bars and stores.

Suddenly, companies had to scramble to meet demand. They couldn't hire fast enough to fill jobs - nearly 10.4 million in August - or buy enough supplies to meet customer demands. With business running back, the ports and shipping yards were unable to handle the traffic. Global supply chains have faltered. Costs rose. And companies have found that they can pass those higher costs on in the form of higher prices to consumers, many of whom have been able to reap many savings during the pandemic.

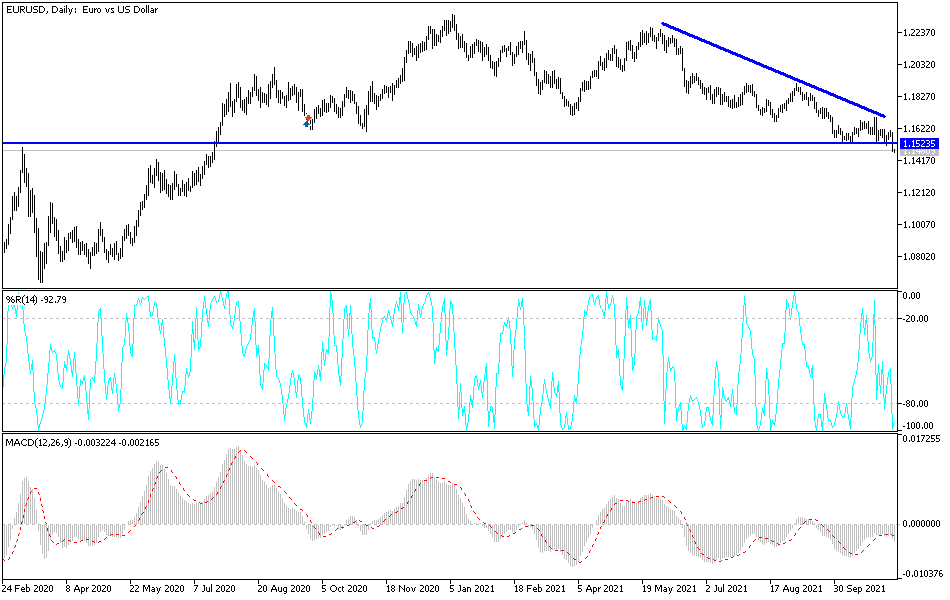

Technical Analysis

On the daily chart, the EUR/USD has broken through an important support area that warns of more bearish pressure and moves to the support levels 1.1425 and 1.1375, which may push the technical indicators towards strong oversold levels. The latter may be a good buying level. On the upside, the resistance levels at 1.1665 and 1.1775 are vital for a bullish change in the general trend, which is still bearish.

There is an American holiday today that may weaken liquidity, but at the same time, yesterday's results from the US inflation data will still have a reaction on investor sentiment.