US retail sales numbers joined the list of releases which are fueling expectations of a raising of US interest rates soon. This increased downward pressure on the EUR/USD currency pair, which collapsed to the 1.1263 support level, its lowest in 16 months, before settling around 1.1300 as of this writing. We warned of the continuation of the trend in previous analyses, and the pair actually moved to all the levels we expected.

The move for the lower EUR/USD comes amid rising COVID cases in the Eurozone that threatens to slow the region's recovery, contrasting with the more constructive pandemic situation in the US and accelerating economic growth in the region. The EUR/USD pair broke new lows after the release of US retail sales data on November 16 that beat expectations for a 1.7% month-over-month gain in October, and the market was eyeing 1.2% growth. This, combined with continuous improvements in the labor market and skyrocketing inflation, is keeping the door open for interest rate hikes in 2022 by the US Federal Reserve, while the European Central Bank sees such a move likely only by 2024.

Germany leads the Eurozone numbers in infections by COVID. Greece is currently reporting the highest numbers of confirmed coronavirus cases for the pandemic and the highest COVID-19 death rate in six months. Accordingly, the government has re-imposed some restrictions targeting the approximately one-third of the population that is still not immune. Greek health authorities reported a daily record of new cases, with 8,129 infections recorded within 24 hours. They also reported 80 more deaths from COVID-19, bringing the country's total death toll from about 11 million to nearly 17,000.

The Eurozone economy grew at a slightly faster pace in the third quarter, as previously expected, and estimates from the European statistics agency Eurostat showed. Gross domestic product grew 2.2 percent from the previous quarter, when it was up 2.1 percent. The rate was in line with estimates released on October 29. On an annual basis, the bloc's economic growth slowed to 3.7 percent from 14.2 percent in the previous period. The annual rate also matched the initial estimate.

The European GDP advanced 2.1 percent on a quarterly basis, taking annual growth to 3.9 percent in the third quarter. Moreover, the data showed that the number of people employed in the Eurozone rose by 0.9 percent sequentially, faster than the 0.7 percent rise recorded in the second quarter. Similarly, annual growth improved to 2% from 1.9%.

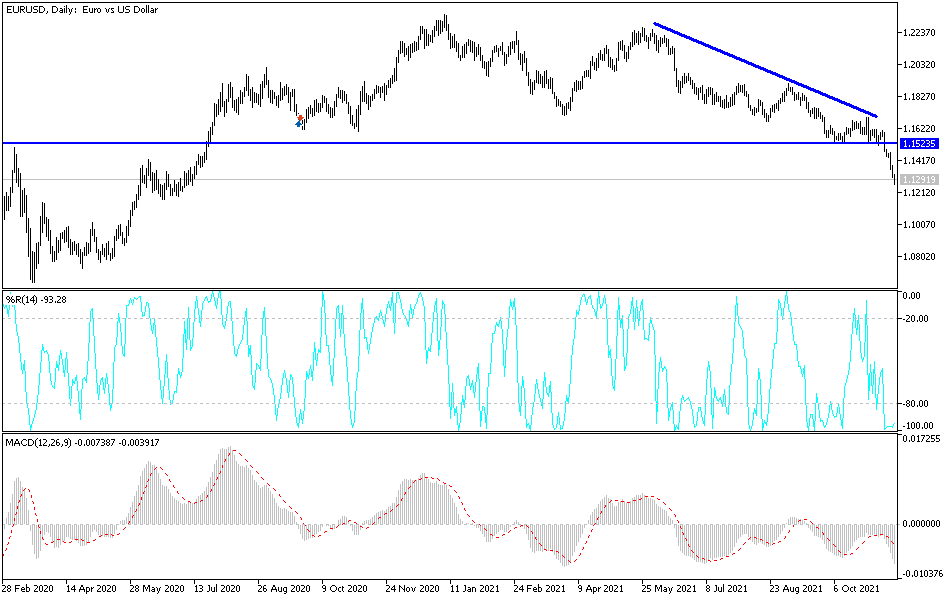

Technical Analysis

The movement of technical indicators towards strong oversold levels is no concern for the bears as long as the pressure factors on the pair exist and are increasing. Therefore, it does not rule out the next stronger support level at 1.1160 and even the psychological support at 1.1000 as long as the euro stays weak. On the upside, and according to the performance on the daily chart, the pair must breach the 1.1530 resistance first to form a base to launch the correction. Otherwise, the general trend of the EUR/USD will remain bearish.

The euro will be affected by the release of CPI figures in the Eurozone, US housing data, building permits and housing starts.