Today's trading session is an important one with the releases of significant US economic data, ahead of the Thanksgiving holiday that will affect liquidity in the markets. The price of the EUR/USD currency pair is preparing for today with bearish stability around a 16-month low, as the pair collapsed this week to the 1.1226 support level.

The euro is experiencing a strong decline against the rest of the other major currencies due to COVID. Its losses were temporarily halted with the help of supportive comments from members of the European Central Bank (ECB) Council. Isabel Schnabel, a member of the European Central Bank's Executive Board, said "inflation risks are skewed to the upside" and joined a fellow board member in downplaying the negative impact of renewed Covid restrictions in the Eurozone.

Commenting on this, Carsten Brzeski, analyst at ING Bank, says: “If a member of the ECB Executive Board describes inflation risks as “skews to the upside”, this is a clear sign that a gradual exit from ultra-loose monetary policy is about to begin. The last time the European Central Bank conducted such an assessment of inflation risks was in 2014!"

Prior to the comment, the euro had been struggling, weighed down by investor fears regarding a new wave of Covid infections spreading across Europe. But the single European currency made a turnaround after Schnabel said in an interview that uncertainty had increased as to when inflation would fall back to the ECB's 2.0% target, and "we have to take this heightened uncertainty into account." "It remains reasonable to halt PEPP procurement in March of next year," she also said. PEPP is the European Central Bank's Covid emergency quantitative easing program which sees the bank provide liquidity to the economy through its purchase of government and corporate bonds.

When the PEPP ends, it is important because it indicates how quickly an interest rate hike can follow.

Schnabel addressed the imposition of new restrictions to curb the spread of Covid in some Eurozone countries, saying, "While coronavirus cases and new containment measures may dampen economic activity in the short term, they are unlikely to impede the overall recovery." This perforates the narrative that rising COVID-19 cases in the Eurozone will pressure the ECB into a more pessimistic stance, as it reiterates the need for supportive monetary conditions to support the recovery. Such a “pessimistic” attitude tends to give way to a weaker euro, but when investors inhale the “hard” turn, the currency finds itself supported.

Indeed, Schnabel's comments suggest that the ECB is now more concerned about rising inflation than about Covid restrictions. Commenting on this, ING's Brzeski says this is the first time that an ECB Executive Board member has made a hawkish comment. He says it confirms ING's view that the European Central Bank will announce a scaling back of its asset purchase program at its December meeting.

Schnable's message underpinned her view that central banks need to retain discretion to be able to respond to all contingencies, and adherence to policy for an extended period may constrain policy options in the event of upward inflation risks. The subtext here is that the status quo of low versus longer interest rates embodied in ECB policy can be challenged when conditions change.

Money markets resumed calculating a 10 basis point interest rate increase from the European Central Bank in December 2022, after pricing it briefly last week. The potential "hardening" shift by the ECB was reinforced by ECB Governing Council member Claes Knott who said in an interview that ECB interest rates will likely rise after 2022. This is important because it opens the door to a rate hike In 2023, in contrast to the European Central Bank's preferred guidance for a rate hike in 2024.

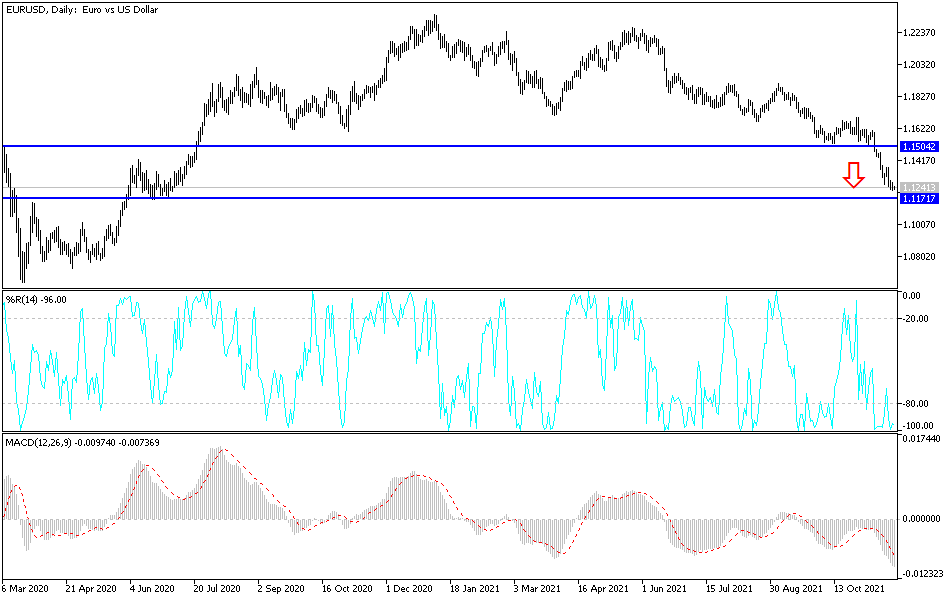

Technical analysis

The general trend of the EUR/USD is still bearish, and according to the performance on the daily chart, stability below the 1.1300 support opens for a move further downwards. Currently, the closest support levels for the pair are 1.1220, 1.1155 and 1.1070. This is not out of the question as long as the US dollar is strong and all factors support raising US interest rates. The euro remained affected by restrictions to contain the waves of Covid 19. On the upside, the bulls need to break through the 1.1380 and 1.1530 levels to break the current trend.

I still prefer to sell EUR/USD from every bullish level.

From the Eurozone, the German Ifo business climate index will be announced. In the United States of America, there will be the growth rate of the gross domestic product, orders for durable goods, the reading of the number of weekly jobless claims, the reading of the personal consumption expenditures price index, the Federal Reserve’s preferred measure for measuring US inflation, and then the content of the minutes of the last meeting of the US Federal Reserve.