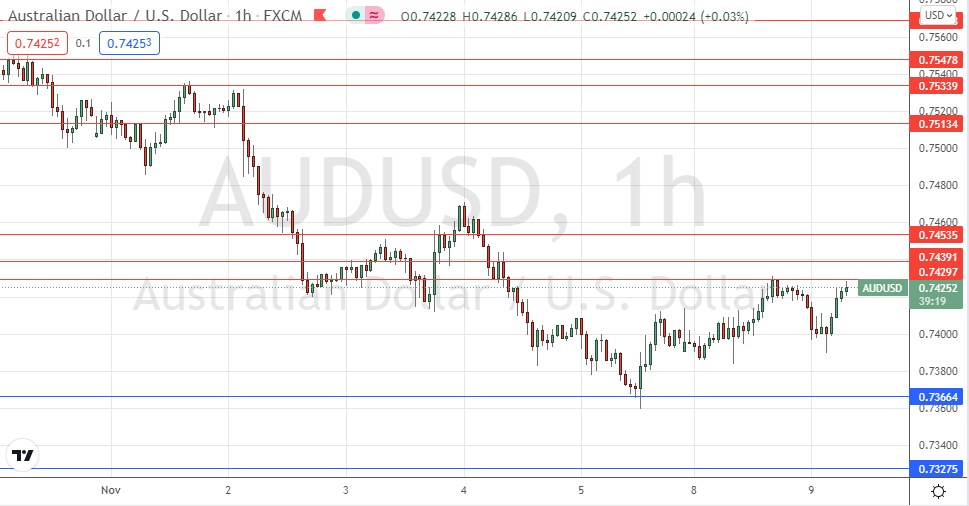

Last Tuesday’s AUD/USD signal was not triggered as there was no bullish price action when the price first reached the support level which I had identified at 0.7437.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered prior to 5pm Tokyo time Wednesday.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7430, 0.7439, or 0.7454.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7366.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that if the the price could continue falling and get established below 0.7475 over the coming hours, it had a good chance to keep falling to the next support level at 0.7437.

This was a good and accurate call, with the price falling even lower than 0.7437.

The technical picture has changed a little over the past week. We now see the downwards price movement having bottomed out, with the price now consolidating below 0.7430. The US dollar is selling off almost everywhere, but it is interesting that it looks a bit stronger here than it does against other currencies, which suggests that long trades in this currency pair might not be a good idea.

The price may continue to rise and break above 0.7430, but the resistance level does look quite strong, and it might provide a short trade – I will be prepared to go short if we get a firm reversal off this level today if it continues to hold.

If the price does break bullishly above 0.7430, I doubt it will be able to get much higher as there are two resistance levels above that within the next 25 pips or so, therefore I am not interested from a long trade today unless the price falls to 0.7366 and bounces bullishly there, which is unlikely.

Concerning the USD, there will be a release of PPI data at 1:30pm London time. There is nothing of high importance scheduled for release today regarding the AUD.