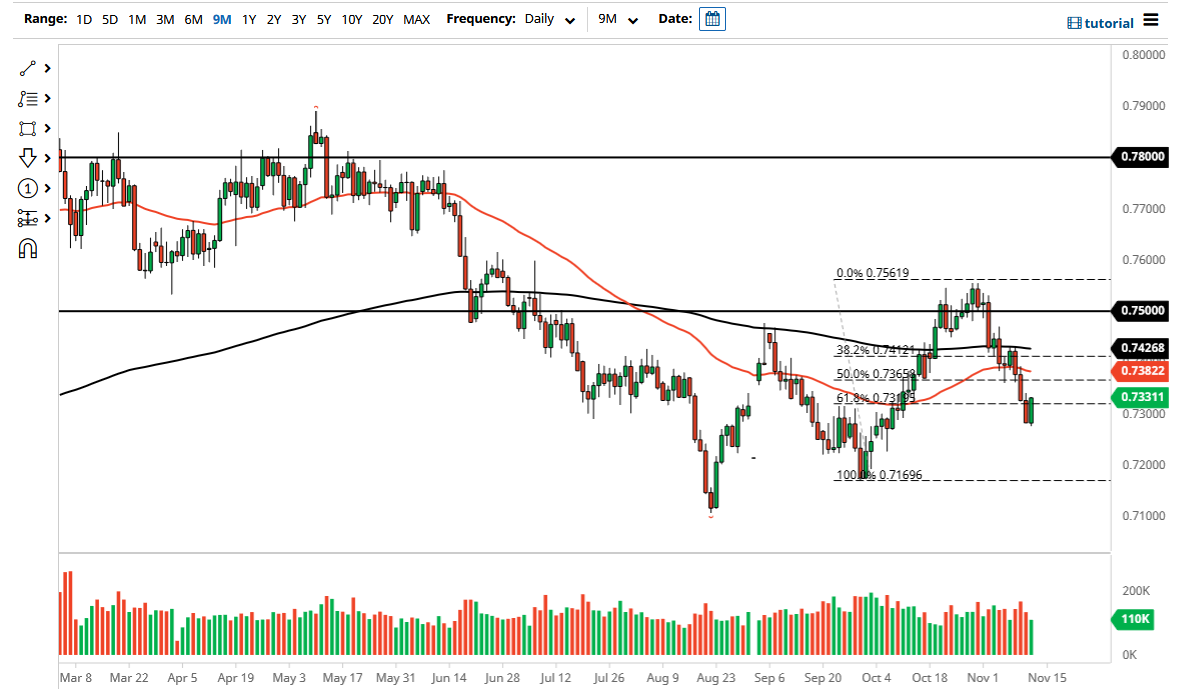

The Australian dollar has been selling off for several days in a row, but Friday saw a bit of bullish pressure to break back above the 0.73 level. That is a good sign, at least for stabilization. I suspect that there is probably a bit of short covering that we are looking at, so I do not necessarily think that anything has changed longer term. At this point, the market could see a little bit of a bounce that we can take advantage of at the first signs of exhaustion. I suspect that the 50-day EMA could be where a lot of technical traders will be looking.

Underneath, the 0.7275 level has offered significant support as we have bounced to take out the selling pressure from the previous session. However, there is still a lot of downward momentum and I think it is only a matter of time before we see a return to what has recently happened. The interest rates in the United States have rallied quite significantly, but they did fall just a bit after the University of Michigan Consumer Sentiment came out much lower than anticipated. With this being the case, the market started to see bond yields drop a bit in America, but at the end of the day I think that is probably just a bit of a “knee-jerk reaction.”

The Australian dollar has to worry about the fact that the Reserve Bank of Australia has been a bit more dovish than anticipated over the last week or so, and of course we have issues in China. The Chinese have massive issues when it comes to their local economy, so it is more than likely going to be a drag on the Aussie dollar as it is so highly correlated to the Chinese economy in the demand for hard assets coming out of the island. As long as we have a slowdown in China, that will continue to be a bit of an issue for Australia itself. The 50-day EMA is starting to curl a little bit lower of course, and the 200-day EMA is just behind and following the same pattern. Because of this, longer-term traders are starting to look at this through the same prism as well, so that is something to watch.