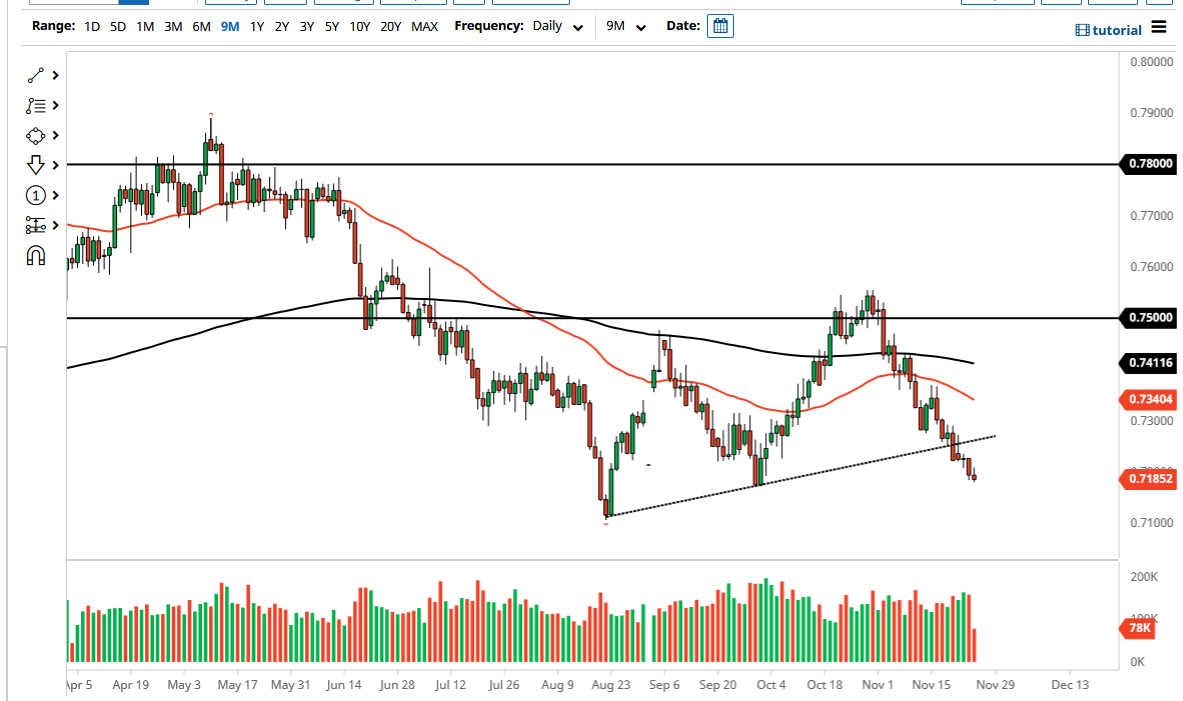

The Australian dollar continues to slump against the US dollar, even though the Thanksgiving holiday in the US should have given it a little bit of a reprieve. At this point, the Australian dollar looks very broken, but it is obvious that we are oversold at the moment. Nonetheless, these trends can last longer than you expect, so I am not willing to jump in and start buying in order to “catch a falling knife.” Rallies will more than likely continue to be sold into, especially near the previous trendline. Any signs of exhaustion near that trendline would have me short of this market, as it should show signs of continuation. Even if we break above there, then the 50 day EMA comes into the picture.

When I look at this chart, I do believe that it is only a matter of time before we see the market break down below the structural low at the end of September. Once that happens, it opens up the possibility of a move towards the 0.70 level, which is ultimately on my longer-term target. In fact, I do not necessarily have a scenario in which I buy the Australian dollar, at least not anytime soon.

Having said that, if we were to take out the 50 day EMA and perhaps even the 0.74 level, I would have to rethink the entire position. At that point, it would become obvious that the Aussie dollar had recovered quite a bit, especially in the face of such US dollar strength. Remember, the Federal Reserve is likely to continue tapering bond purchases, while the Reserve Bank of Australia is nowhere near it. Keep in mind that the Australian economy has been locked down much longer than the American one, so it does make a certain amount of sense that we would see the US dollar favored in general. Because of this, I think this will continue to be the case heading into the end of the year, perhaps even further than that. Keep an eye on China, it is starting to show signs of buckling under the pressure as well, and that of course has major implications for the Australian dollar as it is so highly levered to that economy. As demand for commodities drop in China, that is only going to put more pressure on the Aussie dollar going forward as well.