WTI Crude Oil enters the start of this week near three-year highs regarding its value. The 76.00 level is within sight and the commodity hit a high of nearly 76.67 on the 28th of September. A combination of factors is causing WTI Crude Oil to test a host of bullish notions. Talk of about a potential energy shortage in Europe is growing louder as winter months are being taken into consideration, a buying spree by China has been widely suggested and the knowledge that OPEC will be holding an important summit this week is a factor too.

On the 21st of September, WTI Crude Oil was trading at nearly 69.50 after coming off highs attained on the 15th of September near the 73.00 mark. This same price level was also tested in the first week of July 2021, which then saw a reversal lower and approximate value of 61.20 traded. However, global trading conditions are displaying more nervousness now than they did in the middle of the summer.

Global market conditions have grown nervous in equities and Forex, and it should be noted that the cost of energy is having an impact on these tensions. Higher expenses for consuming energy clearly is important when inflation is being taken into consideration and this is creating a litany of worries for central banks as they make interest rate policies.

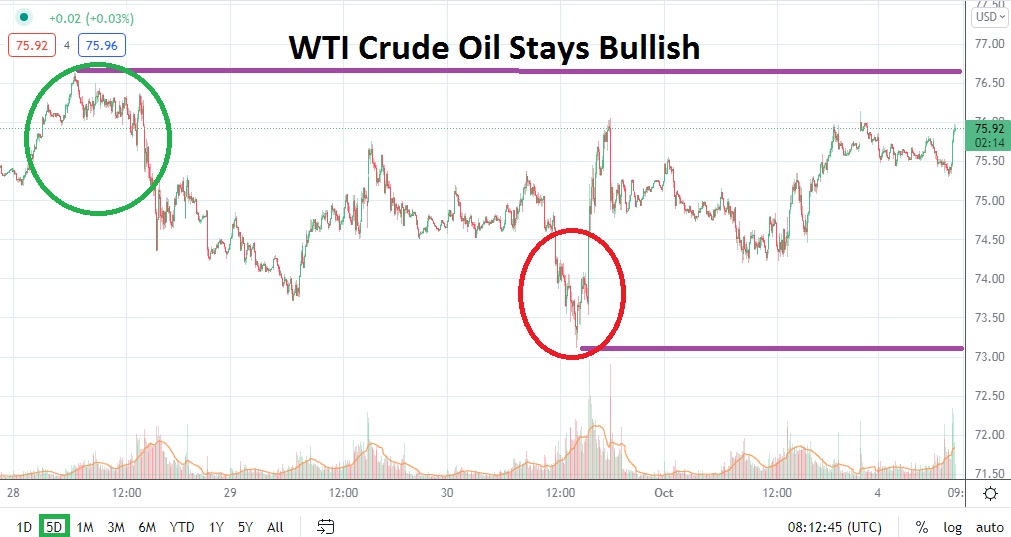

Short-term traders need to be ready for more volatility. If support levels near the 75.00 and 74.00 are able to be sustained in the near term and don’t display price velocity to the downside, this could be a strong indicator that additional bullish action could be generated. The 76.00 mark is certainly important and if early July highs near the 76.80 are challenged this could set off buying momentum which quickly tests highs.

WTI Crude Oil is being watched by many investing participants and its price will have a direct impact on the broad markets. Short-term WTI Crude Oil may prove to be a worthwhile speculative wager if its current support levels near 75.80 to 75.50 remain durable. Traders should use take profit and stop loss ratios to protect against volatility which is certain to be displayed in the short term.

WTI Crude Oil Short-Term Outlook

Current Resistance: 76.40

Current Support: 75.50

High Target: 76.75

Low Target: 74.70